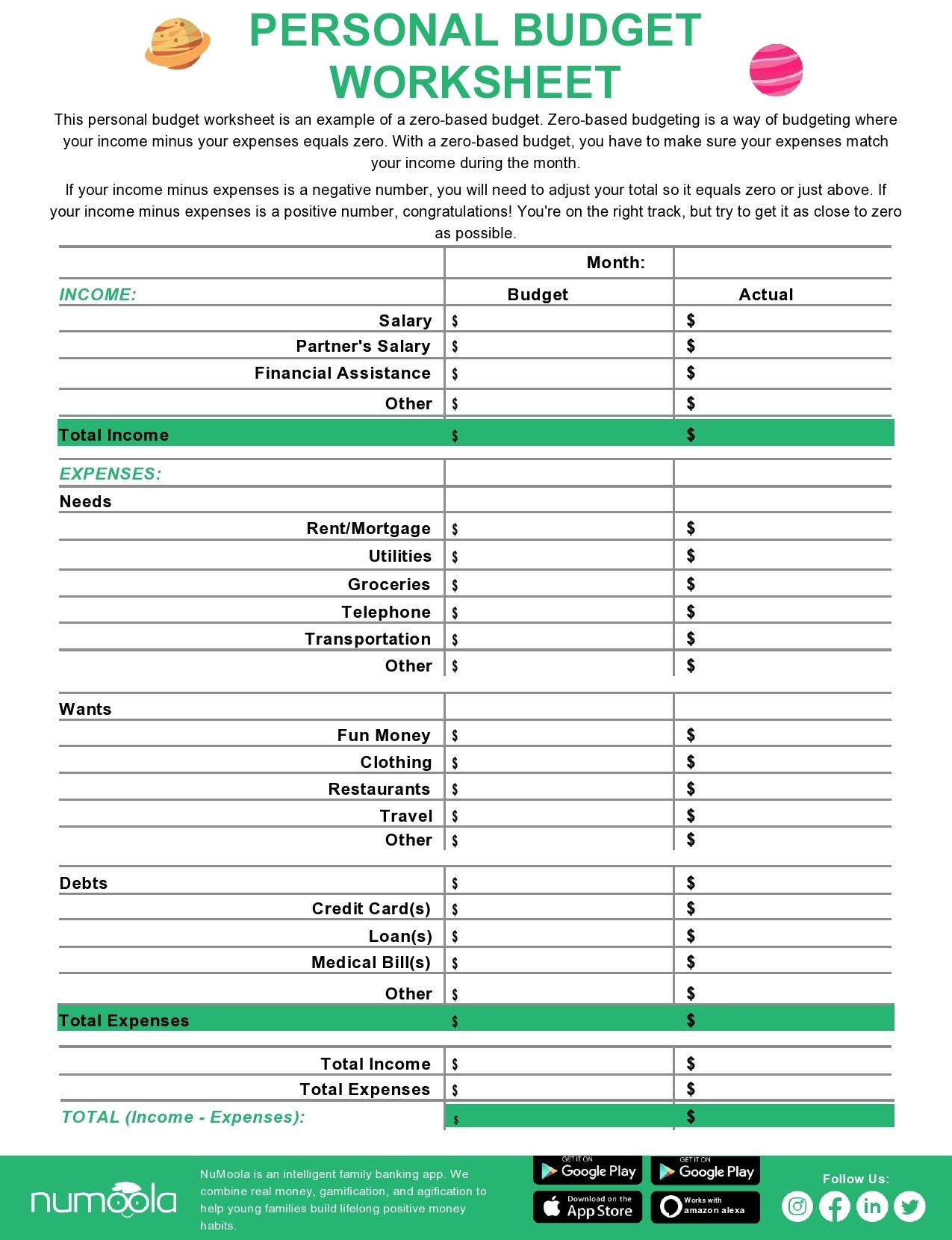

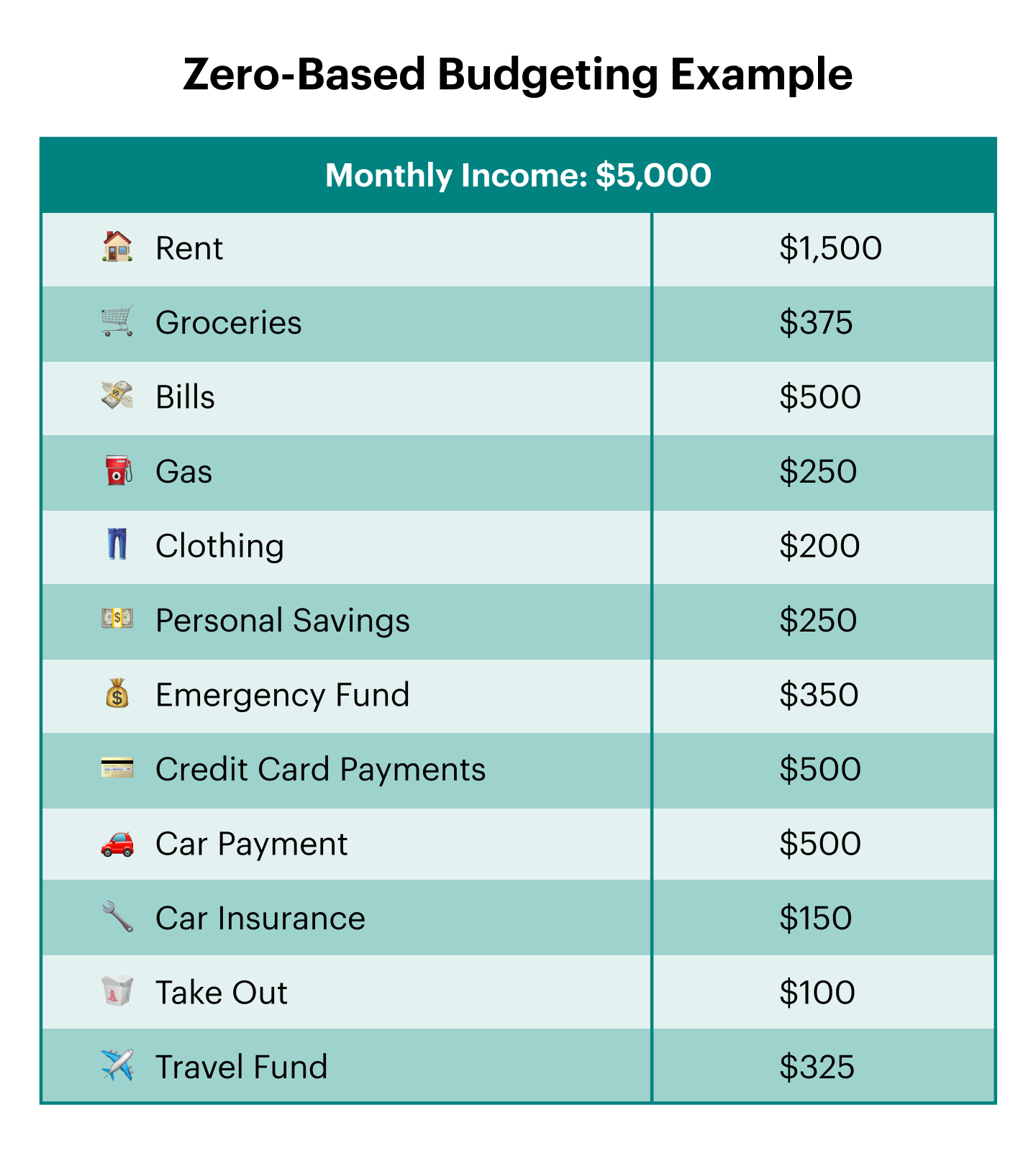

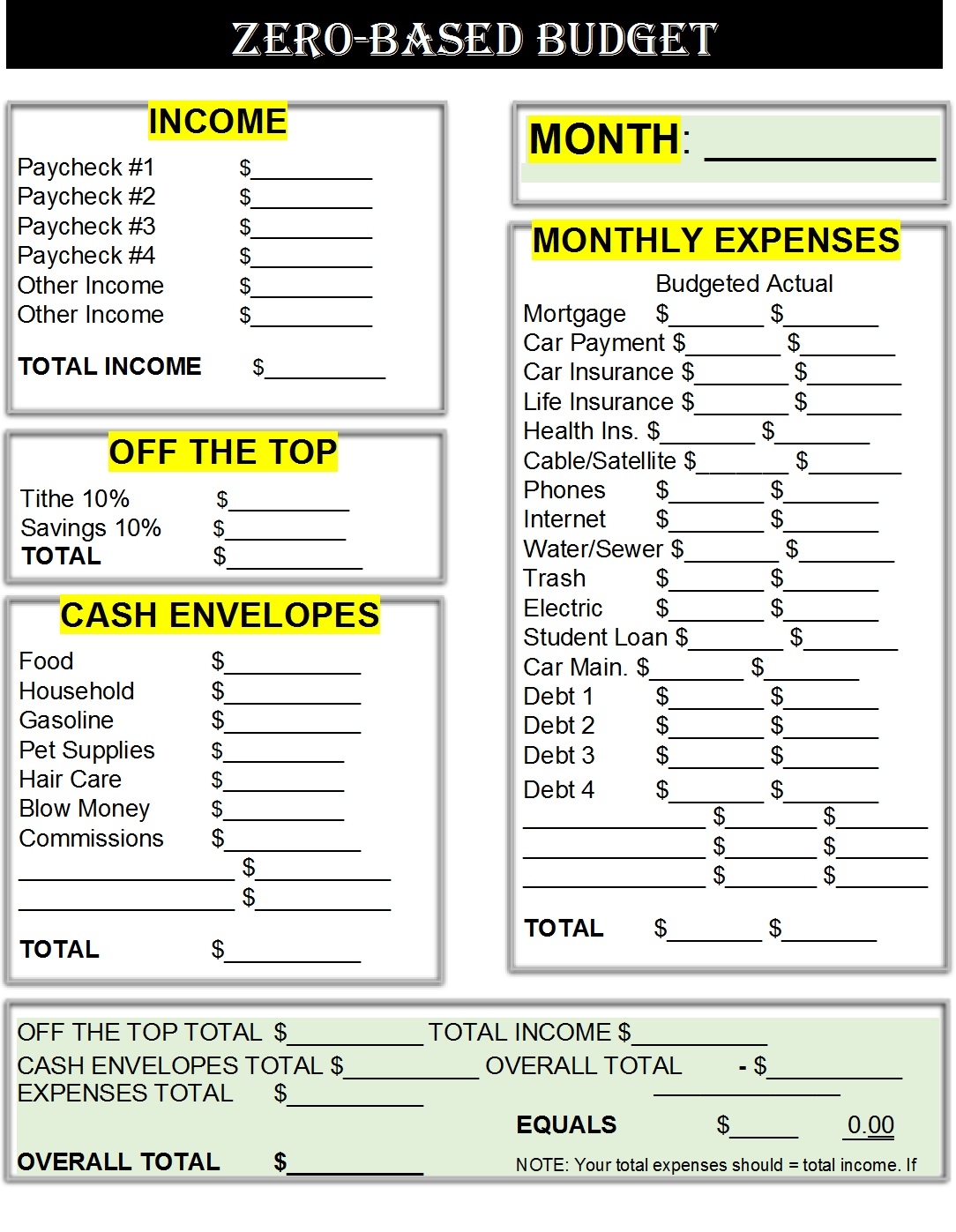

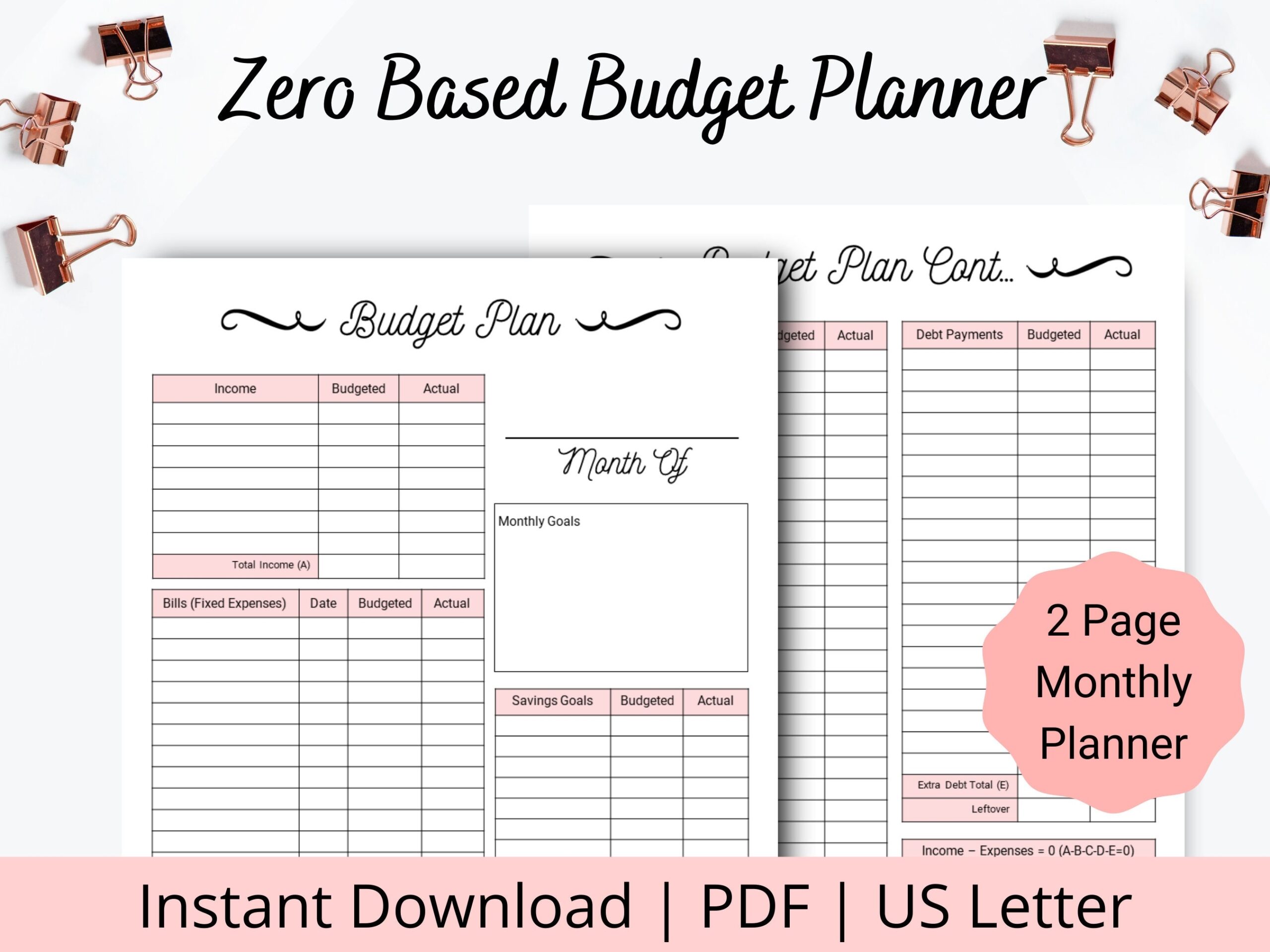

Managing your finances can feel overwhelming, but using a zero-sum budget template can help you take control of your money. By assigning every dollar a purpose, you can track your expenses and savings more effectively.

With a zero-sum budget template, you allocate your income to different categories like bills, groceries, savings, and entertainment. This method ensures that your expenses match your income, leaving no room for overspending or surprises at the end of the month.

Zero Sum Budget Template

Zero Sum Budget Template

Creating a zero-sum budget template is simple. Start by listing all your sources of income and fixed expenses. Then, allocate the remaining funds to variable expenses and savings goals. This approach helps you prioritize your financial goals and make informed decisions about your spending.

With a zero-sum budget template, you can easily identify areas where you can cut back on expenses and increase your savings. By tracking your spending and adjusting your budget as needed, you can achieve your financial goals and build a secure future for yourself.

Remember, a zero-sum budget template is a tool to help you manage your finances, not a strict set of rules. Feel free to customize it to fit your lifestyle and financial goals. The key is to be consistent and disciplined in tracking your expenses and sticking to your budget.

In conclusion, using a zero-sum budget template can help you take control of your finances and achieve your financial goals. By allocating every dollar a purpose and tracking your spending, you can make informed decisions about your money and build a secure future for yourself.

A Detailed Guide To Making A Zero Based Budget Living That Debt Worksheets Library

Zero Based Budget Printable Printable Budget Sheet Zero Based Budget Sheet Zero Based Budget Planner Printable Budget Pages 8 5×11 Etsy

How To Make A Zero Based Budget Mint Notion

40 Best Zero Based Budget Templates Word U0026 Excel