Are you looking for an effective way to manage your business finances? Zero-based budgeting could be the answer! This method involves starting from scratch and allocating funds based on current needs and priorities.

By using a zero-based budgeting template for your business, you can track expenses, identify unnecessary costs, and make informed financial decisions. This tool can help you stay on top of your finances and ensure that every dollar is accounted for.

Zero-Based Budgeting Template For Business

Zero-Based Budgeting Template For Business

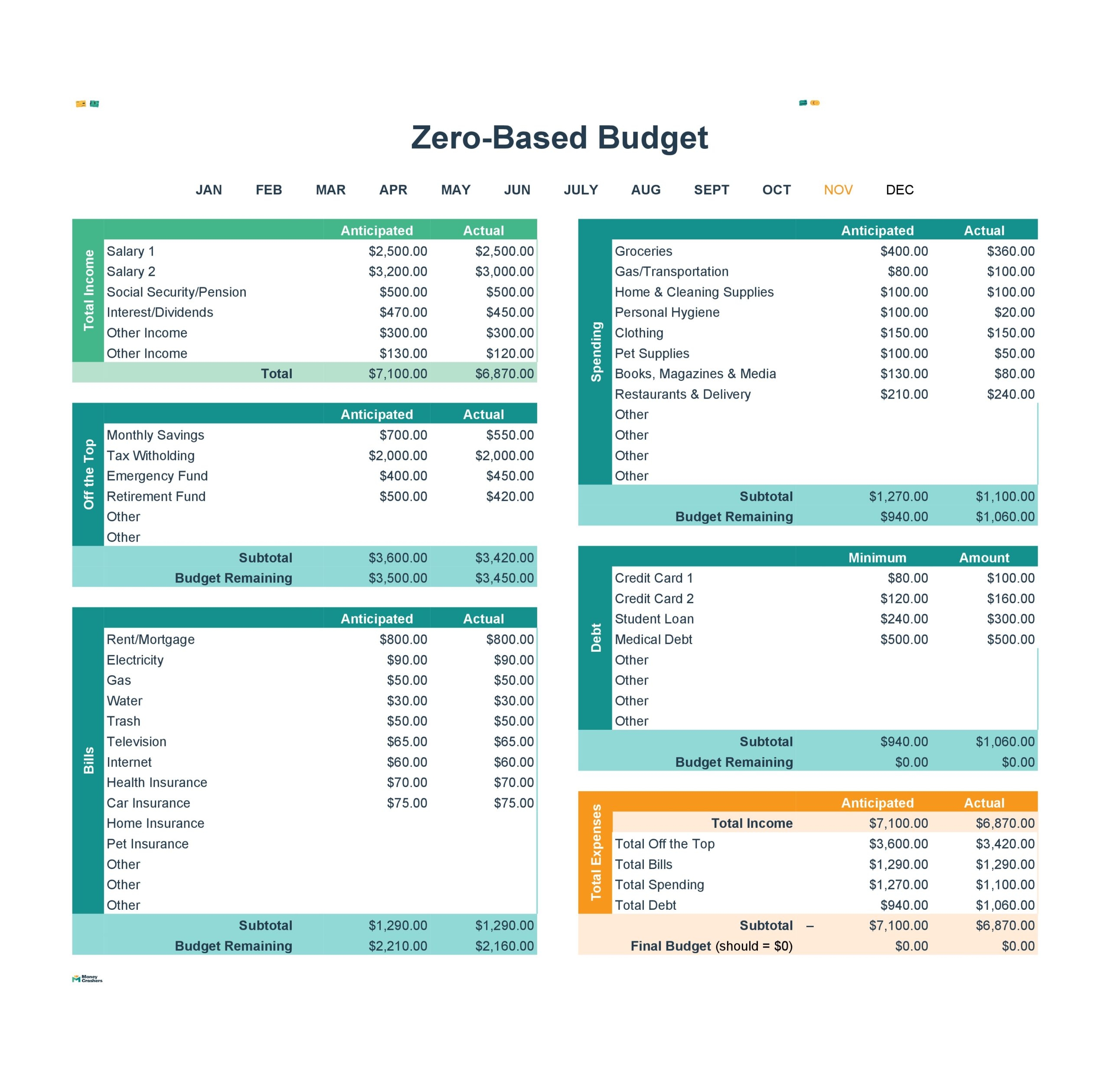

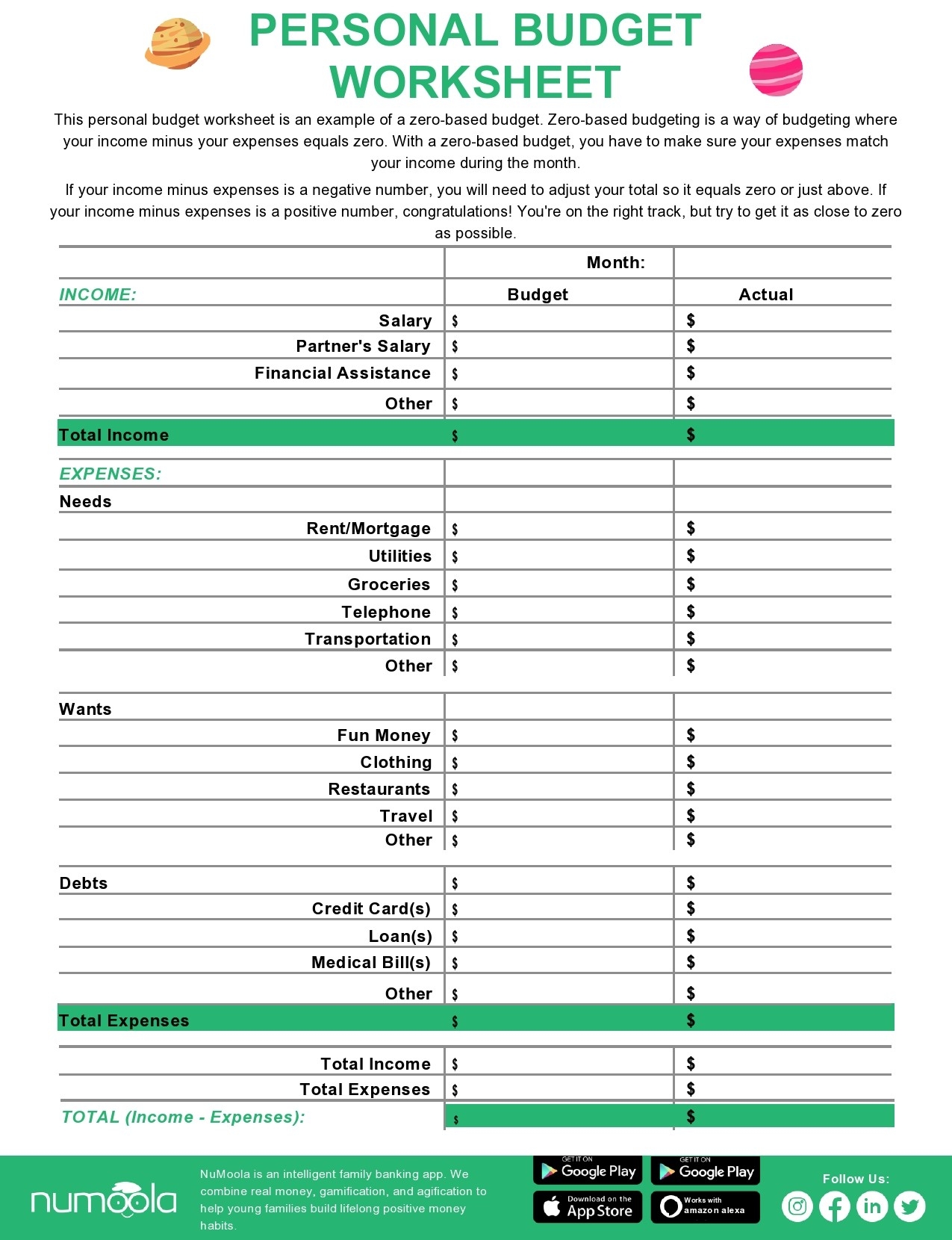

When creating a zero-based budgeting template, start by listing all your sources of income. Then, allocate funds to expenses such as rent, utilities, and payroll. Be sure to include a buffer for unexpected costs and savings for future growth.

Regularly review your budget to track spending patterns and adjust allocations as needed. This proactive approach can help you stay ahead of financial challenges and make strategic decisions for your business. With a zero-based budgeting template, you can take control of your finances and set your business up for success.

In conclusion, using a zero-based budgeting template for your business can provide clarity and organization to your financial management. By starting from zero and allocating funds based on current needs, you can optimize your budget and make informed decisions that benefit your bottom line. Try implementing this tool today and see the positive impact it can have on your business!

Free Printable Zero Based Budget Templates PDF Excel Word

40 Best Zero Based Budget Templates Word U0026 Excel

40 Best Zero Based Budget Templates Word U0026 Excel

40 Best Zero Based Budget Templates Word U0026 Excel

40 Best Zero Based Budget Templates Word U0026 Excel