Managing a two-income household can be challenging, especially when it comes to budgeting. However, with the right tools and strategies in place, you can take control of your finances and achieve your financial goals.

Creating a monthly budget template is a great way to track your income and expenses, identify areas where you can cut back, and save money for the future. By having a clear overview of your finances, you can make informed decisions and stay on top of your financial health.

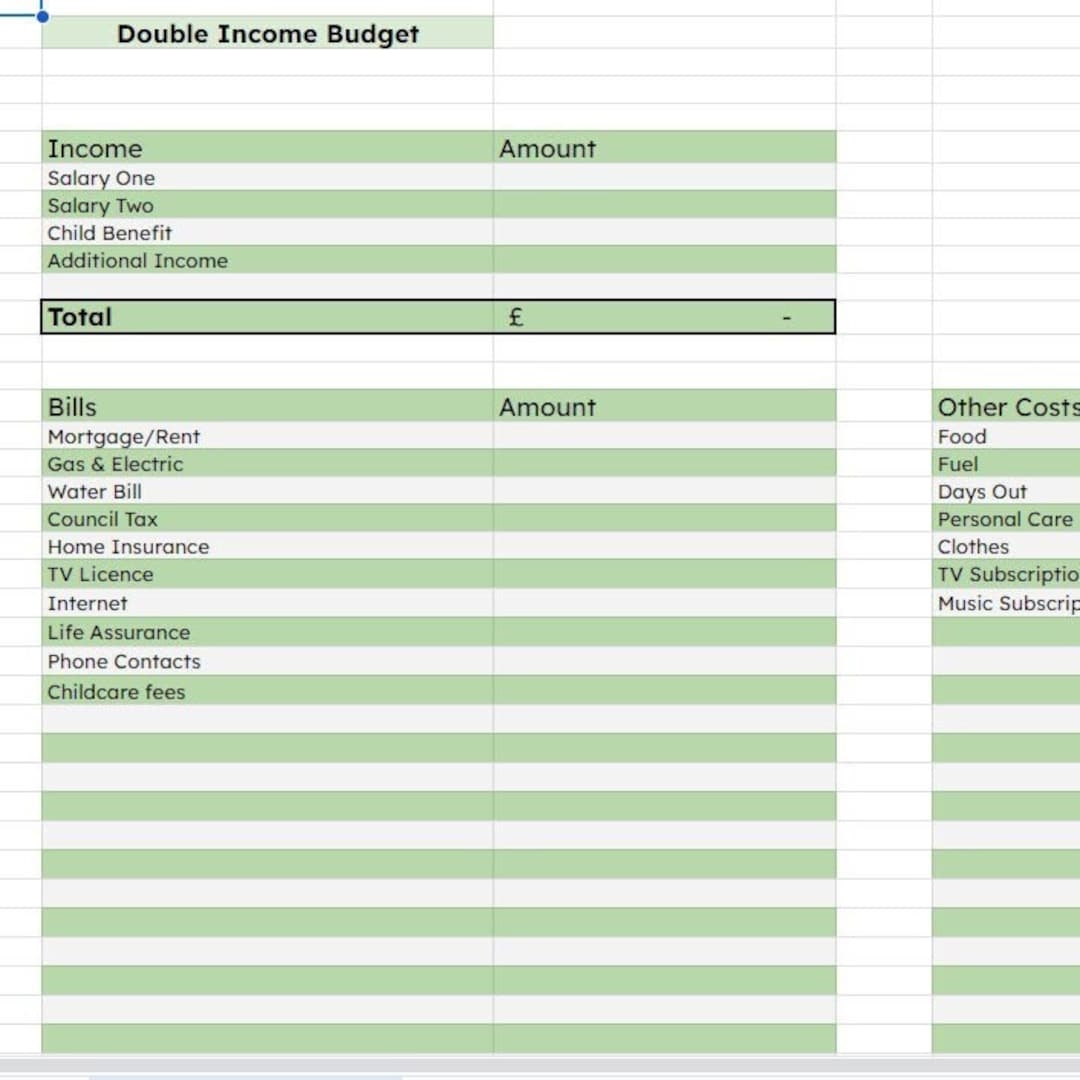

Two Income Monthly Budget Template

Two Income Monthly Budget Template

When creating a two-income monthly budget template, start by listing all sources of income, including salaries, bonuses, and any additional income streams. Next, list all fixed expenses such as rent, utilities, and insurance payments.

Once you’ve accounted for your fixed expenses, allocate a portion of your income to savings, debt repayment, and discretionary spending. Be sure to track your expenses throughout the month and adjust your budget as needed to stay on track.

Remember, budgeting is a flexible process, and it’s okay to make changes as your financial situation evolves. By regularly reviewing and updating your two-income monthly budget template, you can stay in control of your finances and work towards your financial goals.

In conclusion, creating a two-income monthly budget template is a valuable tool for managing your finances effectively. By taking the time to create a budget that works for your unique situation, you can achieve financial stability and peace of mind.

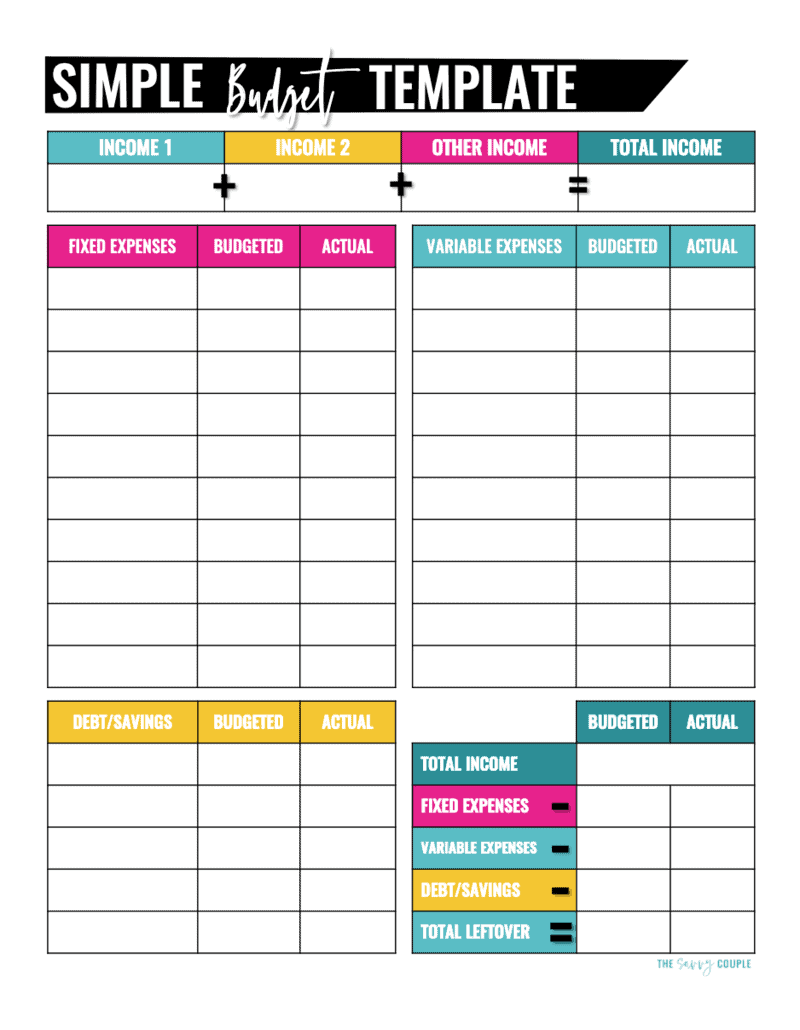

Free And Customizable Budget Templates

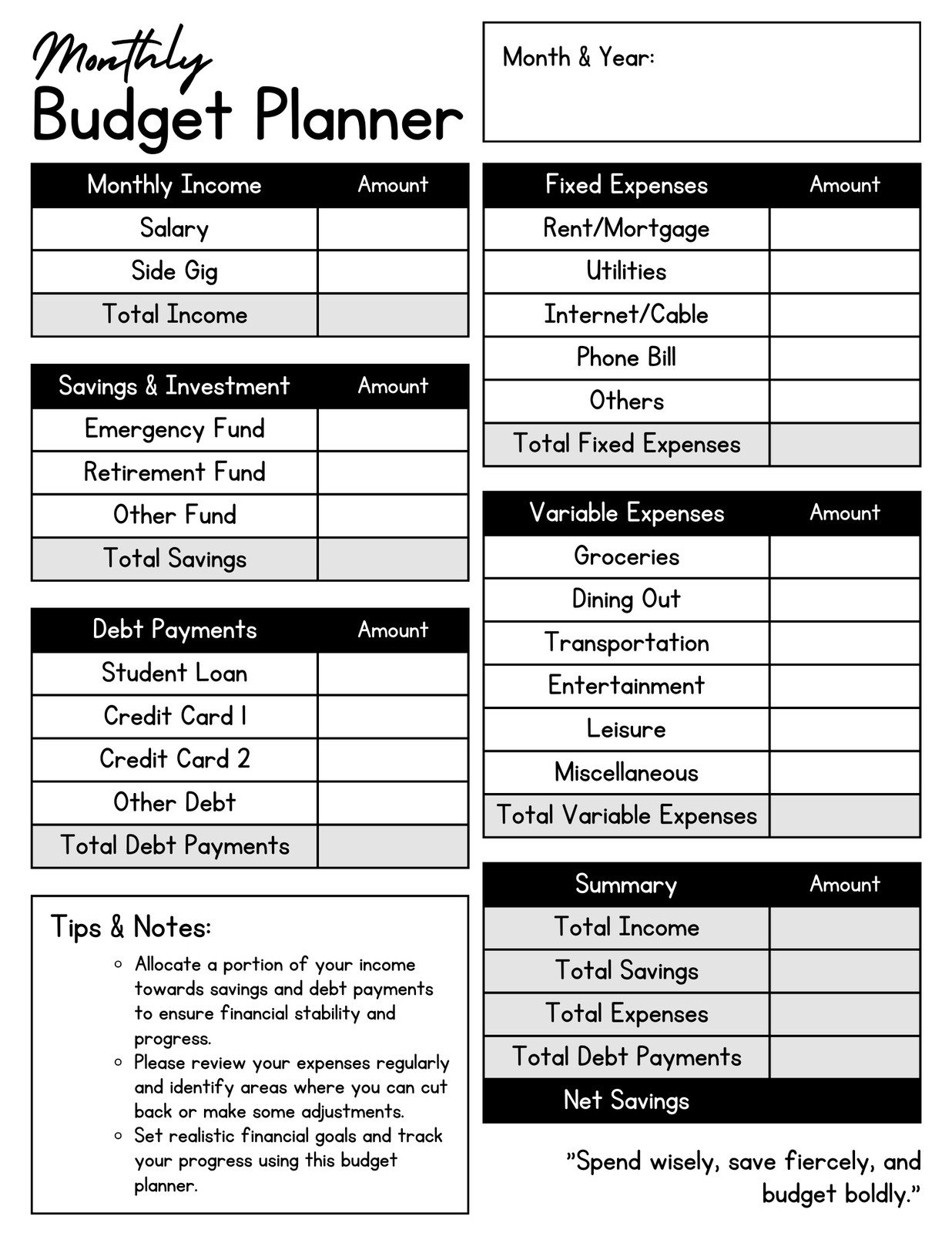

10 Quick Monthly Budget Template Excel Free WPS Office Academy

Free And Customizable Budget Templates

Double Income Budget Spreadsheet Downloadable Family Budgeting Worksheet Etsy