Managing a budget can be challenging, especially for households with two incomes. Knowing where your money is going and how to allocate it effectively is key to financial stability.

Creating a budget template tailored to a two-income household can help you track expenses, save for the future, and achieve your financial goals without unnecessary stress.

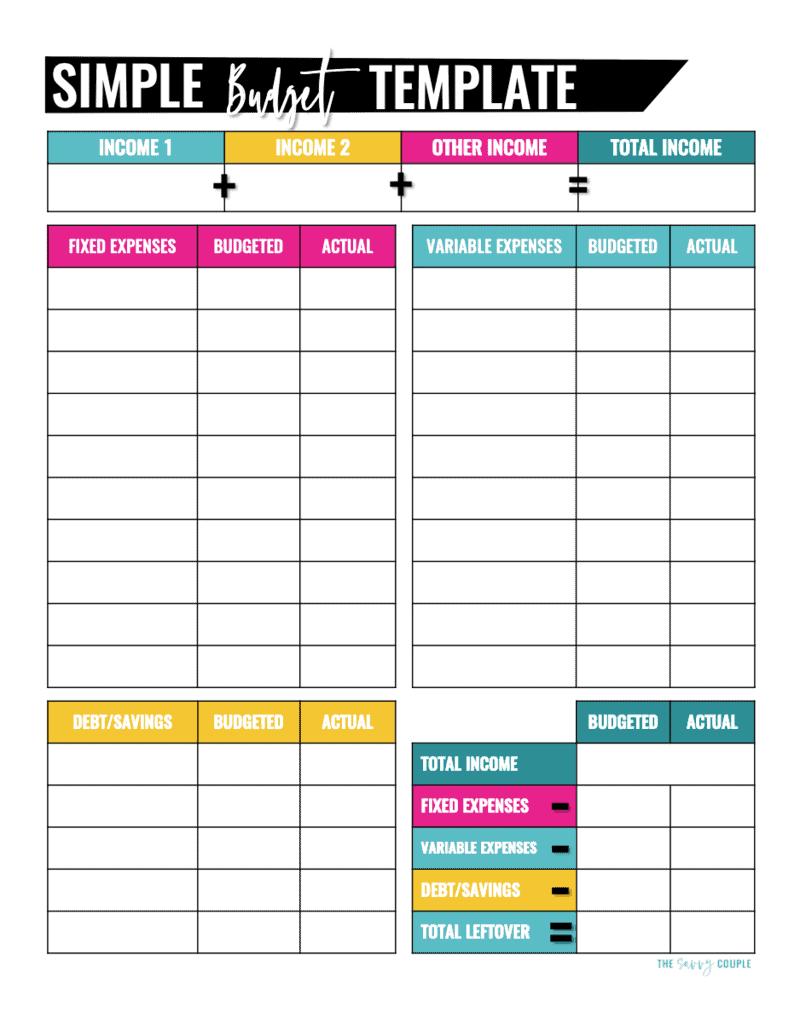

Two Income Household Budget Template

Two Income Household Budget Template

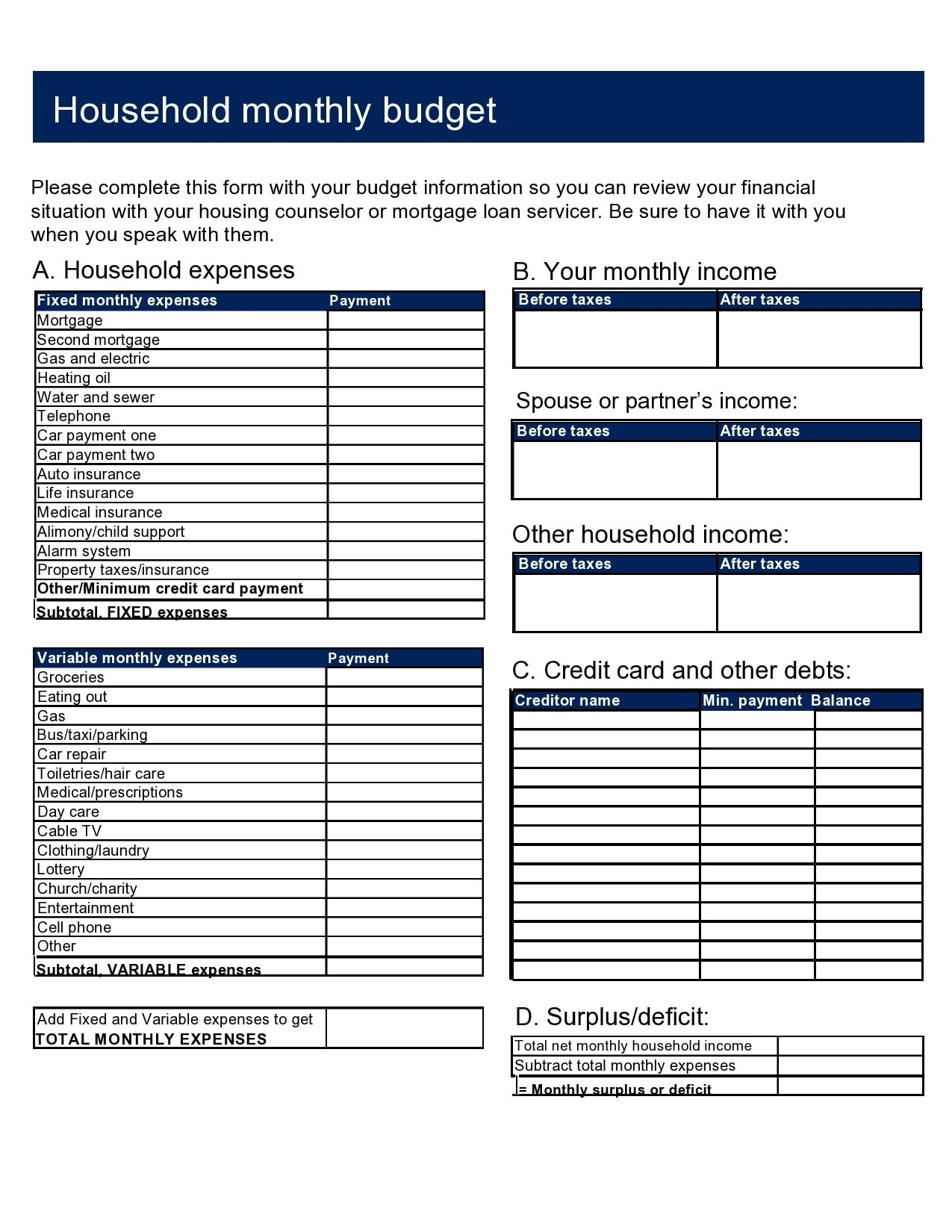

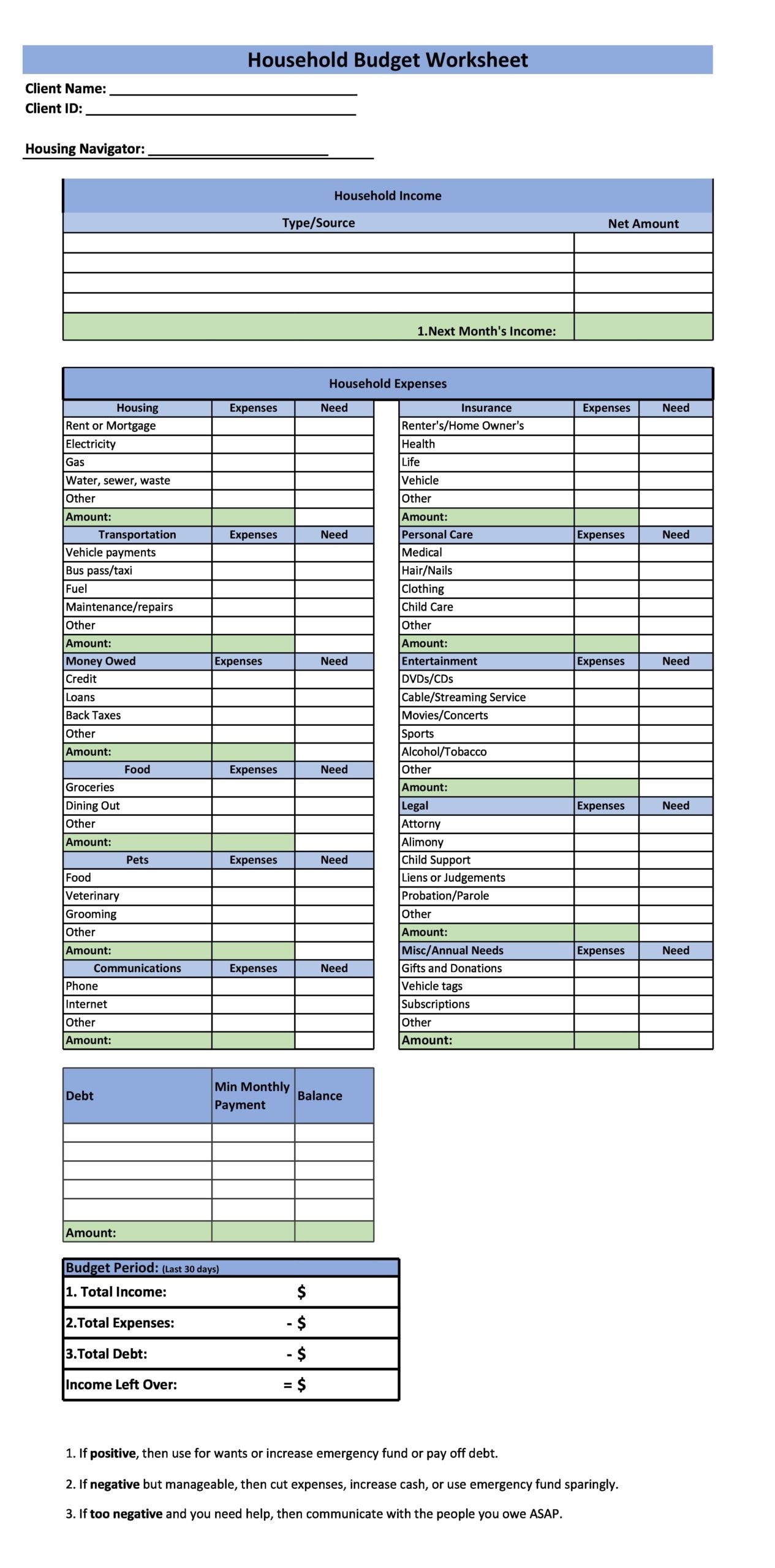

Start by listing all sources of income, including salaries, bonuses, and any additional earnings. Then, outline your fixed expenses such as mortgage/rent, utilities, and insurance. Next, allocate funds for variable expenses like groceries, dining out, and entertainment.

Don’t forget to include savings goals in your budget template. Whether it’s for an emergency fund, retirement, or a vacation, setting aside money each month will help you reach your financial milestones.

Review your budget regularly to track your spending habits and make adjustments as needed. Be mindful of any unexpected expenses that may arise and factor them into your budget to avoid financial strain.

By using a two-income household budget template, you can take control of your finances, reduce money-related stress, and work towards a more secure financial future for you and your loved ones.

Couple s Monthly Budget Spreadsheet Dual Income Savings Planner

28 Best Household Budget Templates Family Budget Worksheets

200 Free Budget Templates In Google Sheets And Excel Thegoodocs

10 Budget Templates U0026 Tools That Will Change Your Life

Double Income Budget Spreadsheet Downloadable Family Budgeting Worksheet Etsy