Are you tired of stressing over your finances? A reverse budget template could be the solution you’ve been looking for. By flipping the traditional budgeting method on its head, you can take control of your money in a whole new way.

Instead of tracking every penny you spend, a reverse budget focuses on setting aside money for your financial goals first. This means prioritizing savings, investments, and debt repayment before allocating funds for day-to-day expenses.

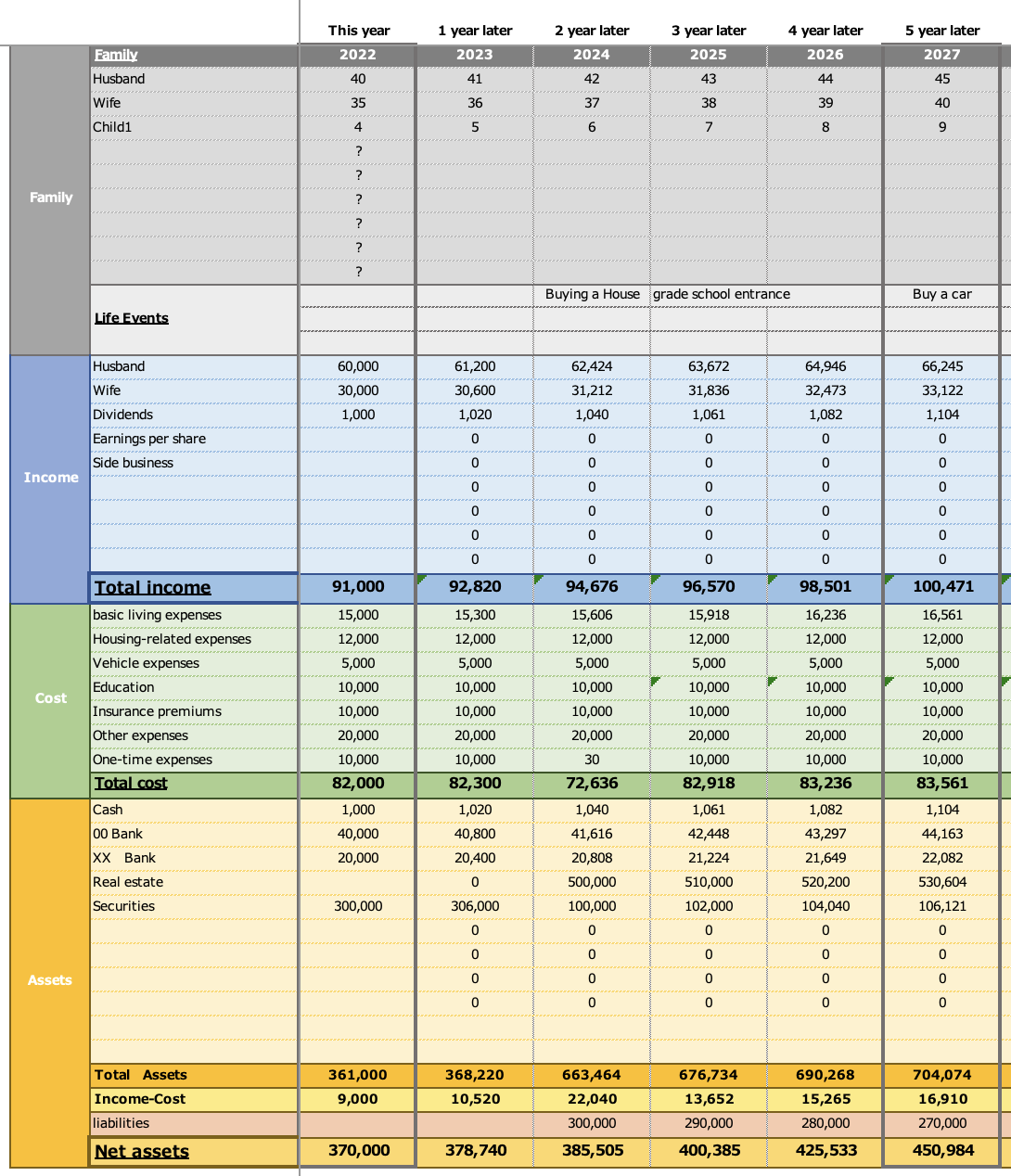

Reverse Budget Template

Reverse Budget Template: A Game-Changer for Your Finances

With a reverse budget template, you can ensure that your financial future is secure while still having the flexibility to enjoy your money today. By putting your long-term goals first, you can make smarter decisions about how you use your income.

Start by listing out your financial goals, whether it’s building an emergency fund, paying off debt, or saving for a major purchase. Then, allocate a portion of your income towards each goal before budgeting for regular expenses like rent, groceries, and entertainment.

By following a reverse budget template, you can make sure that you’re always working towards your financial goals, no matter what life throws at you. It’s a simple yet effective way to take charge of your money and build a solid foundation for your future.

So why wait? Give a reverse budget template a try today and see how it can transform the way you manage your finances. Take control of your money, plan for the future, and enjoy peace of mind knowing that you’re on the right track towards financial success.

How To Budget Your Money Effectively In 4 Simple Steps

Let s Make An Exciting

For Those Who Hate Budgeting Try Reverse Budgeting Route To Retire

Pay Yourself First Creating A Reverse Budget To Reach Your Goals