Starting life after graduation can be an exciting yet challenging time. With new responsibilities and financial obligations, creating a budget is essential to stay on track with your finances.

Managing your money wisely is key to achieving your financial goals. A post-grad budget template can help you take control of your expenses and savings, ensuring a secure financial future.

Post Grad Budget Template

Post Grad Budget Template: A Guide to Financial Success

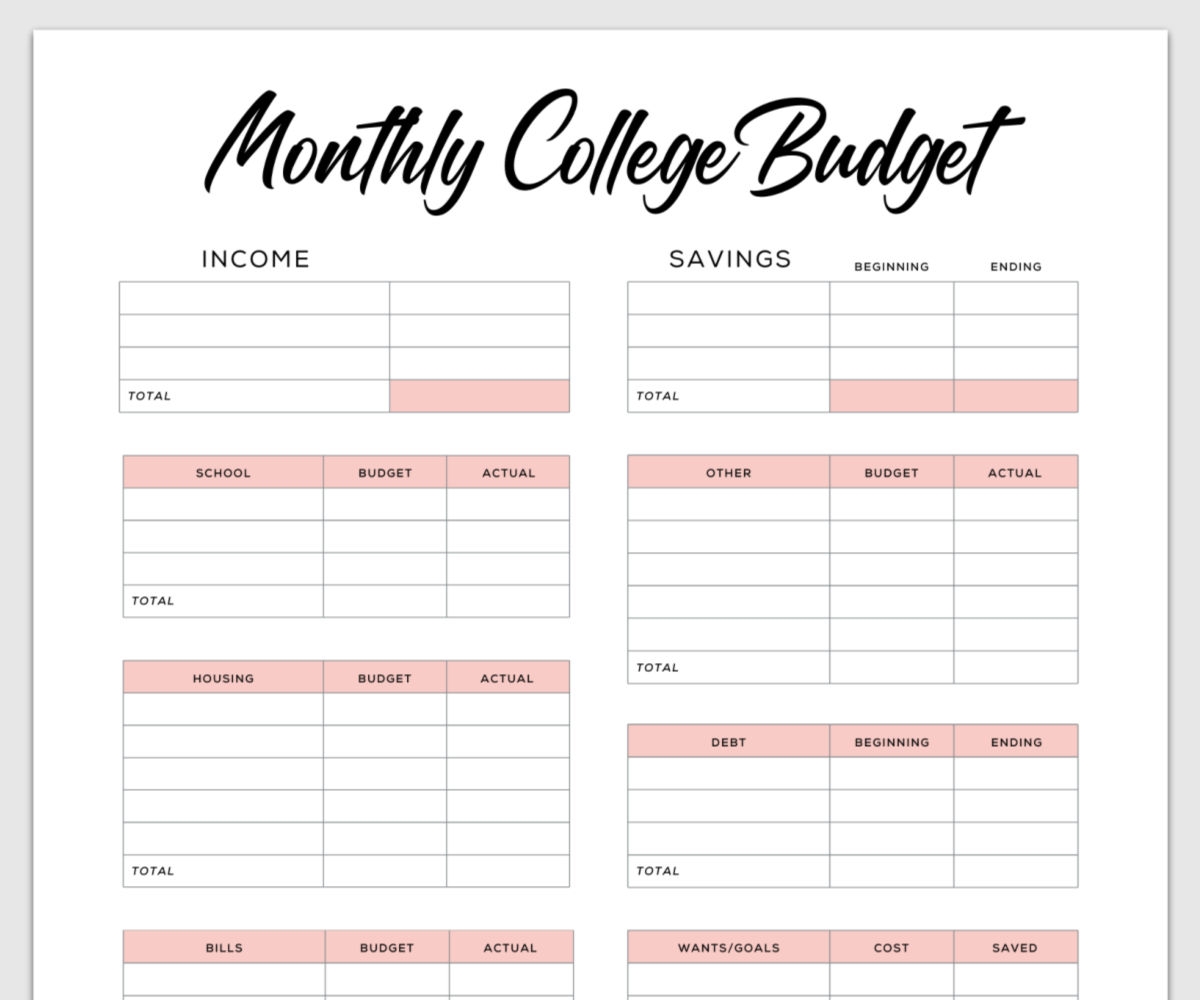

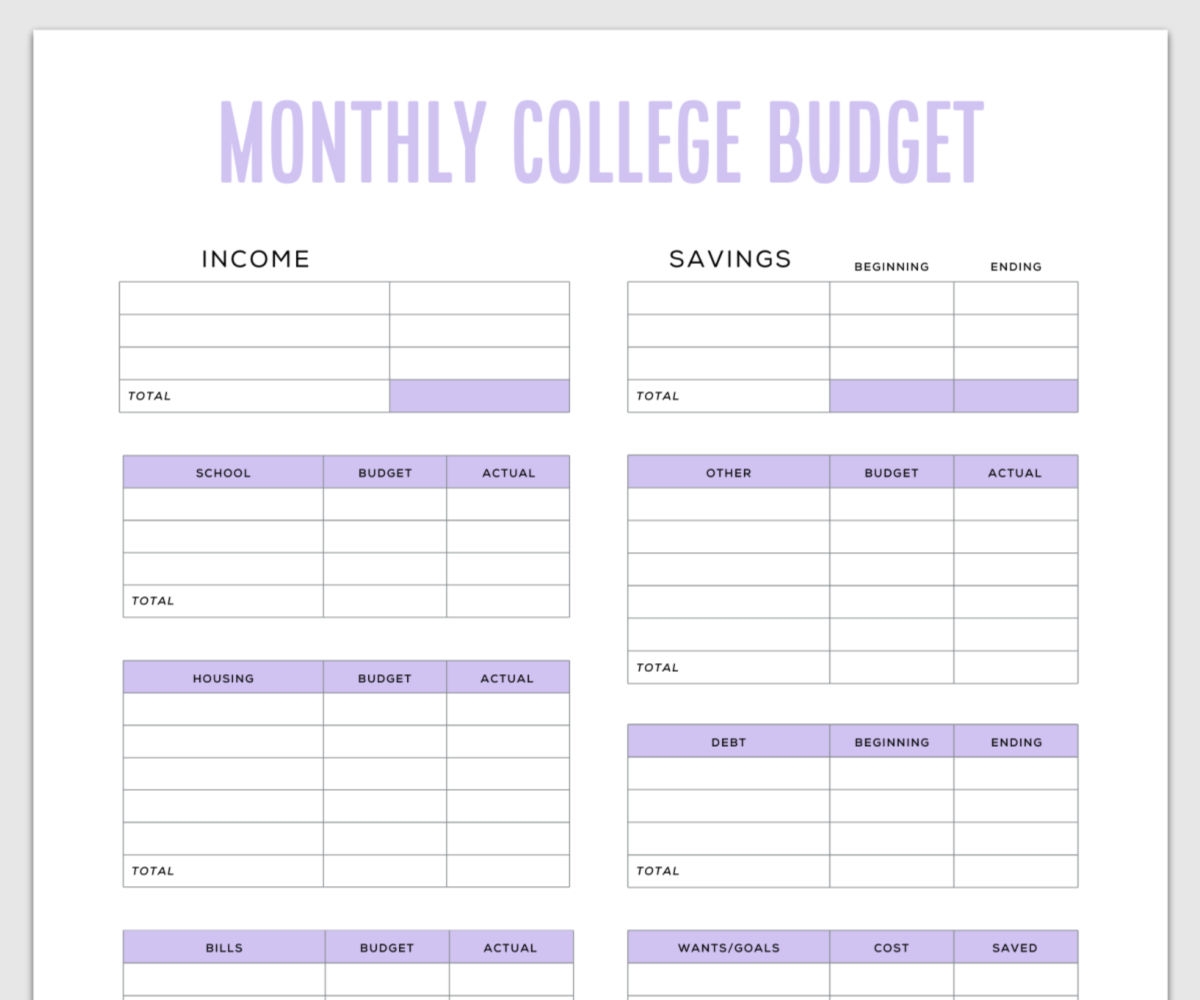

First, list all sources of income, including your salary, freelance gigs, or any passive income streams. Next, track your monthly expenses such as rent, utilities, groceries, and transportation costs.

Once you have a clear picture of your income and expenses, allocate a portion of your income to savings and investments. Building an emergency fund and contributing to retirement accounts are crucial steps towards financial security.

Don’t forget to set aside money for discretionary expenses like dining out, entertainment, and shopping. It’s important to strike a balance between enjoying life and saving for the future.

Regularly review your budget to make adjustments as needed. Life changes, and so should your budget. By staying flexible and disciplined, you can achieve financial success and build a solid foundation for your future.

In conclusion, creating and following a post-grad budget template is a valuable tool for managing your finances effectively. With careful planning and smart decision-making, you can set yourself up for a bright financial future.

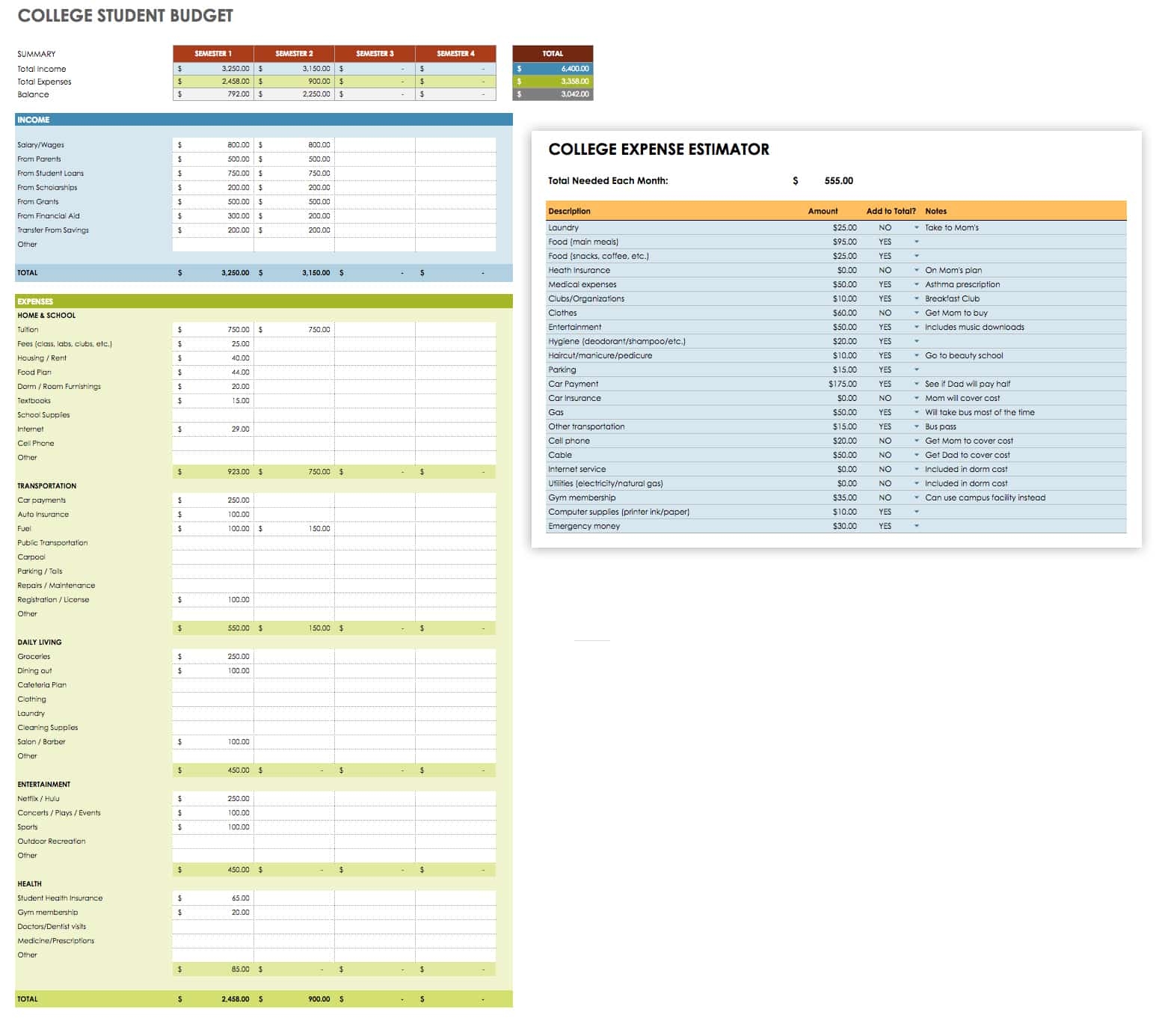

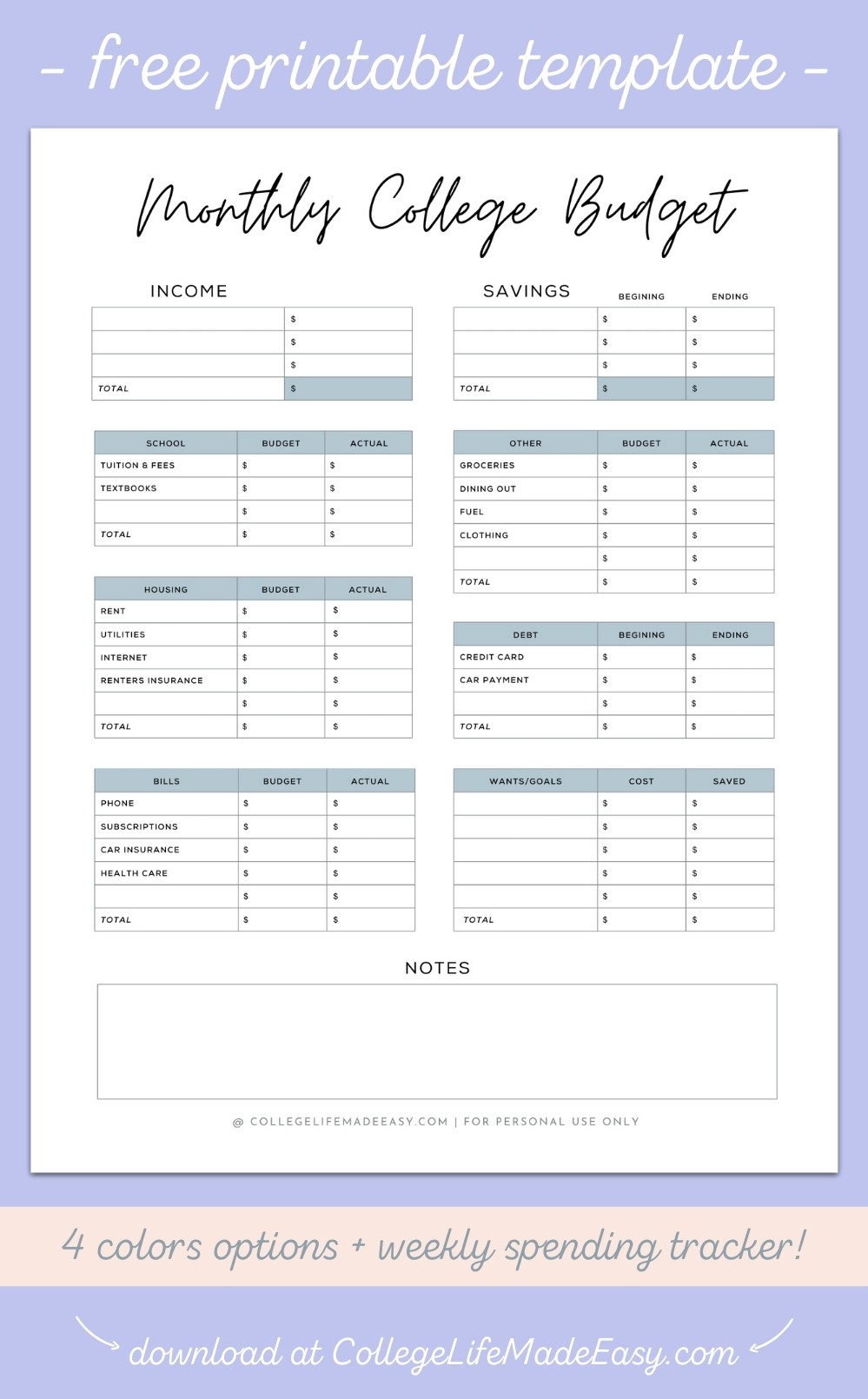

Simple Budget Template For College Students Free PDF

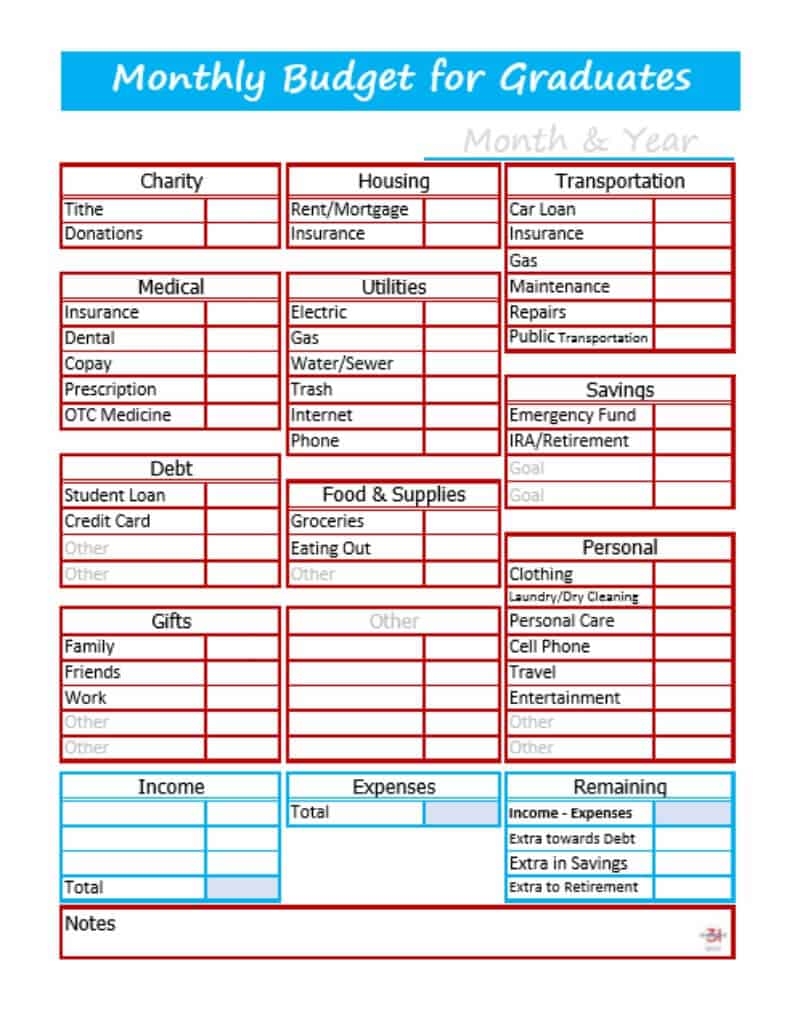

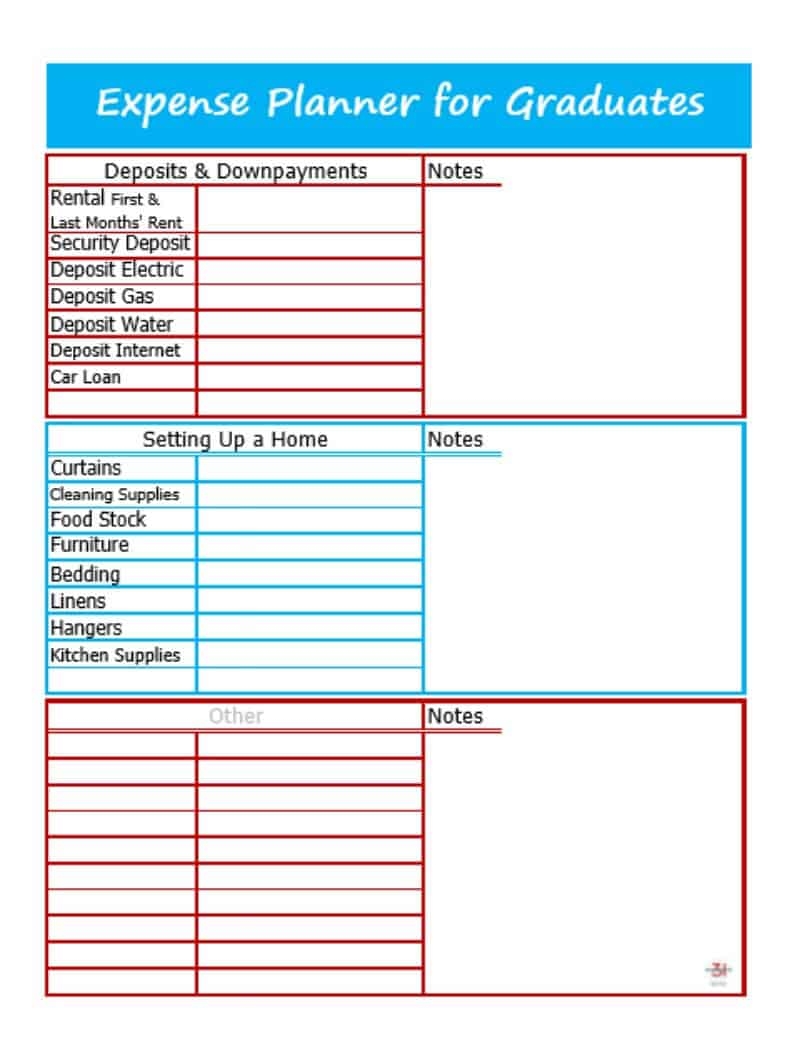

Best Budget Worksheet For Graduates Organized 31

Simple Budget Template For College Students Free PDF

Simple Budget Template For College Students Free PDF

Best Budget Worksheet For Graduates Organized 31