If you’re looking to take control of your finances and stay on top of your expenses, then a personal biweekly budget template could be just what you need. Managing your money doesn’t have to be stressful or overwhelming, and having a budget in place can help you reach your financial goals.

With a personal biweekly budget template, you can track your income and expenses every two weeks, making it easier to see where your money is going and where you can make adjustments. By planning ahead and being mindful of your spending, you can take charge of your financial future and avoid unnecessary debt.

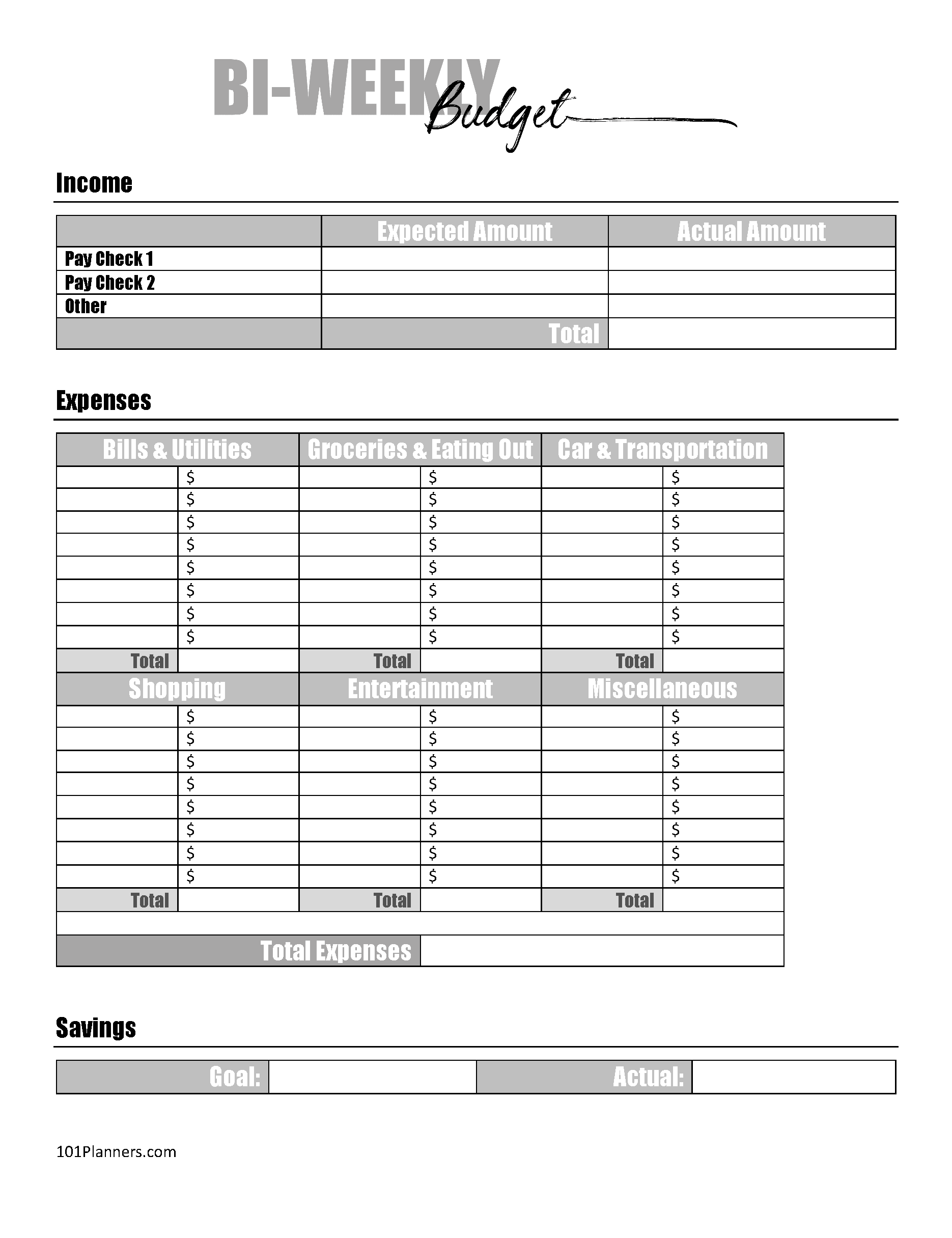

Personal Biweekly Budget Template

Personal Biweekly Budget Template

Creating a biweekly budget template is simple and effective. Start by listing your sources of income, such as your salary or any side gigs. Then, outline your fixed expenses like rent, utilities, and groceries. Don’t forget to include savings and any additional spending categories like entertainment or dining out.

By using a biweekly budget template, you can stay organized and make informed decisions about your spending. It’s a great way to see where your money is going and identify areas where you can cut back or save more. With a little bit of effort and planning, you can achieve financial stability and peace of mind.

Remember, a budget is a tool to help you reach your financial goals, so don’t be afraid to make adjustments as needed. Be flexible, stay focused, and track your progress regularly. With a personal biweekly budget template, you’ll be on your way to financial success in no time.

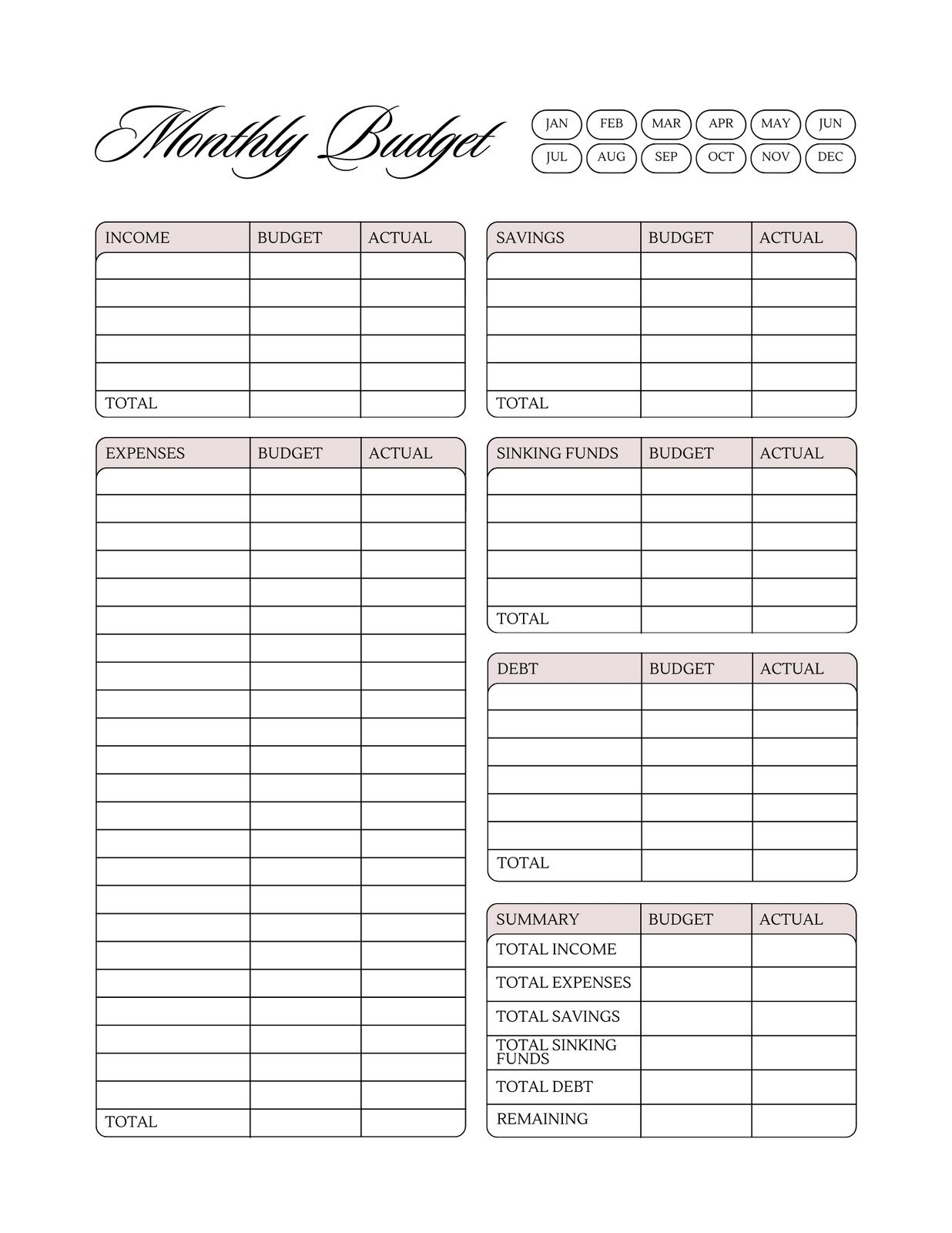

Free And Customizable Budget Templates

Free And Customizable Budget Templates

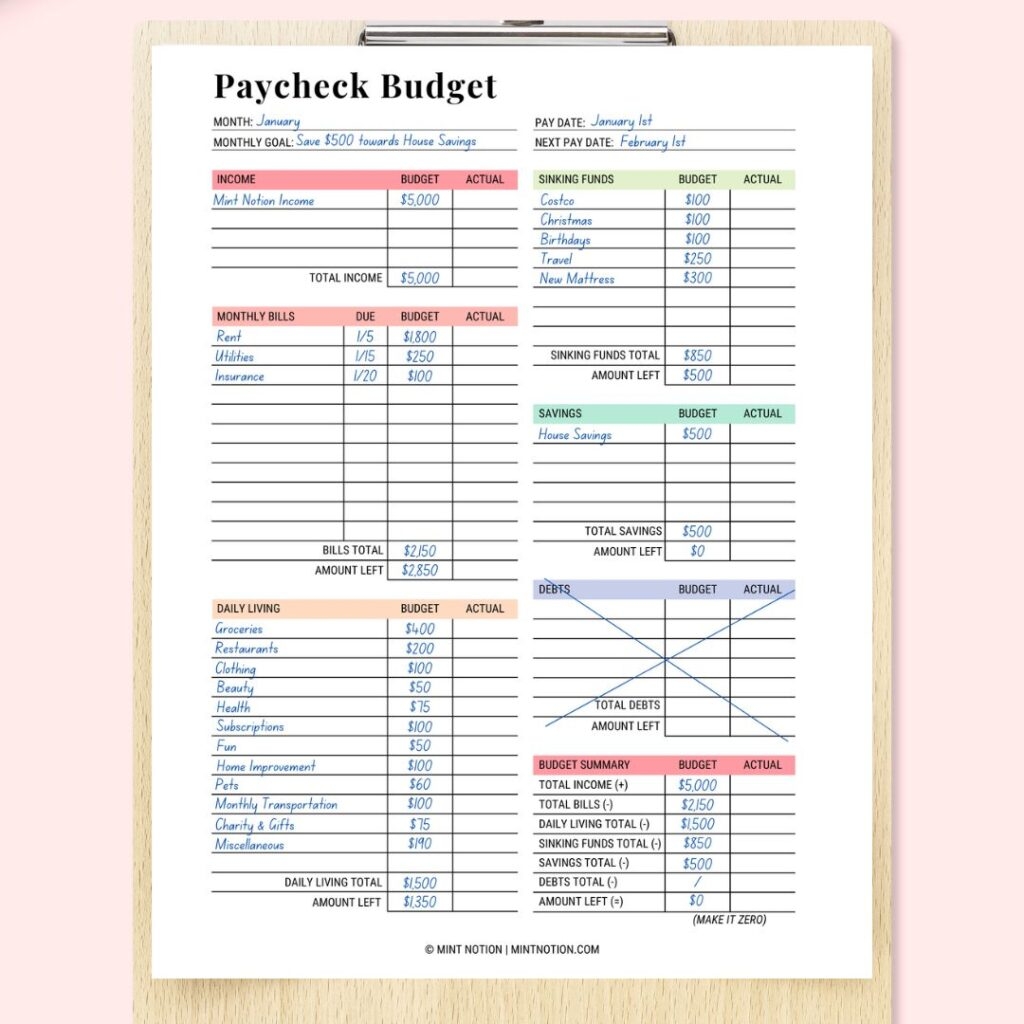

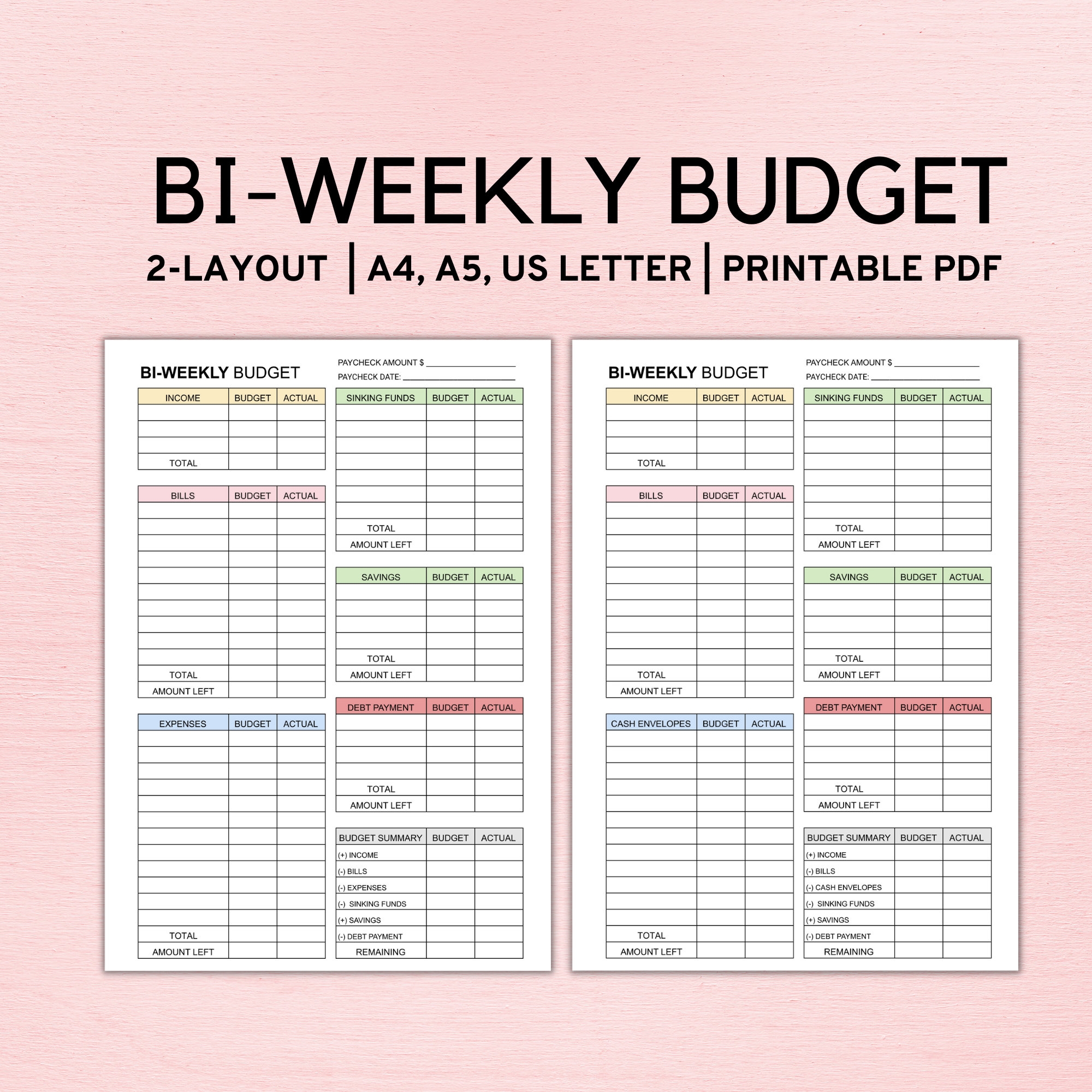

Bi Weekly Budget Planner Template Paycheck Budget Printable Budget Template A4 A5 Letter PDF Etsy UK

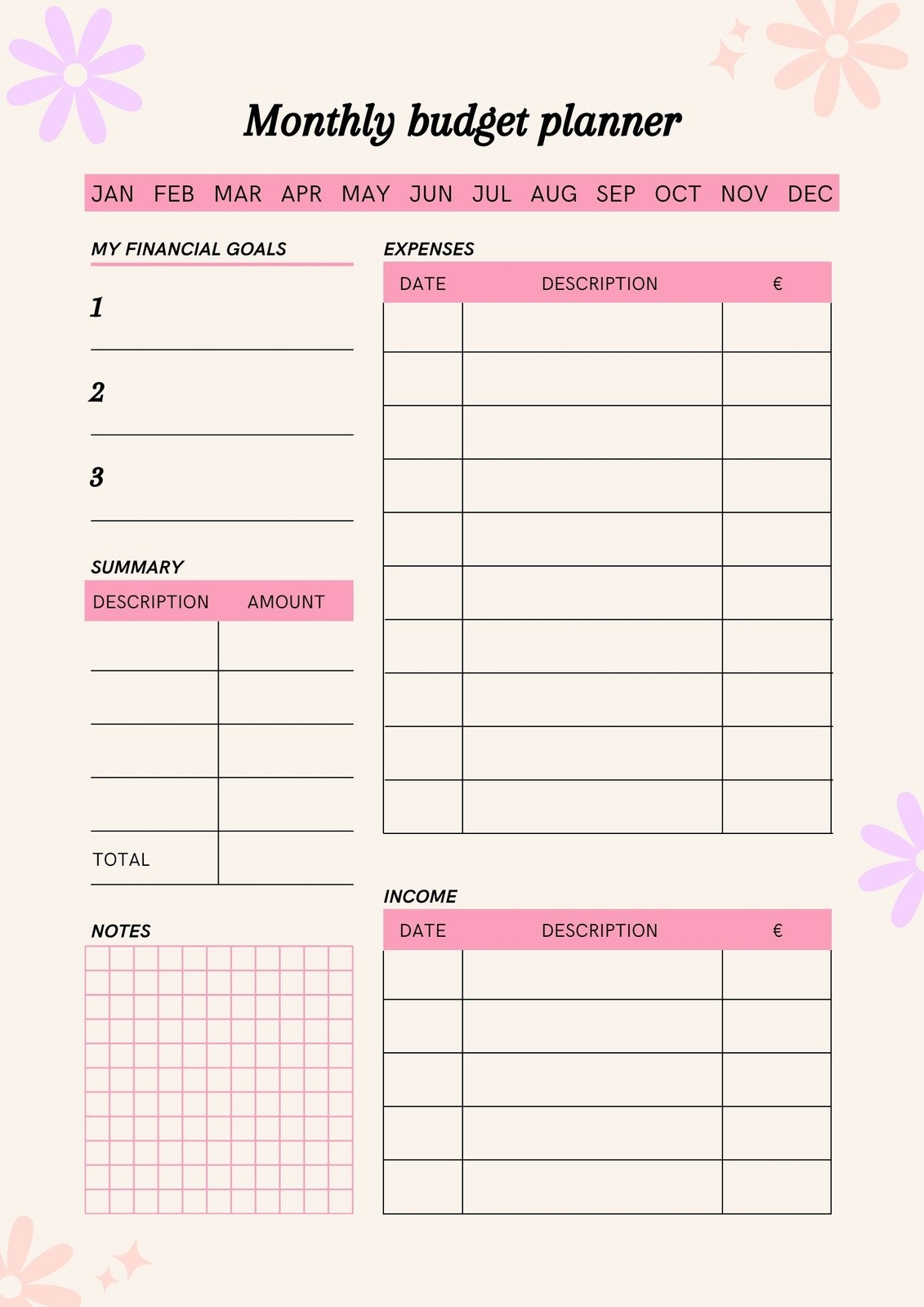

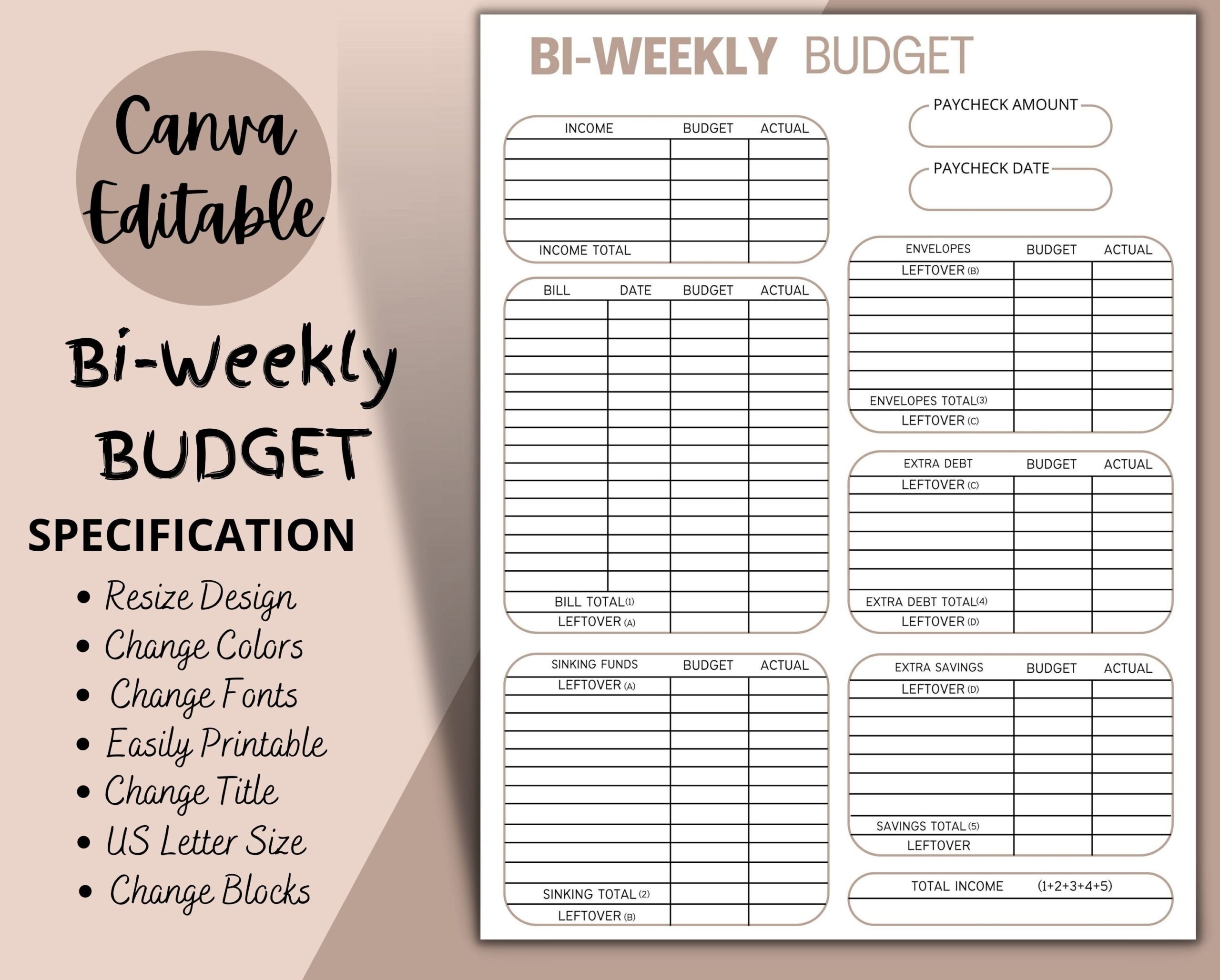

Bi weekly Budget Overview Template Printable Canva Editable Paycheck Budget Budget Binder Budget Planner Budget Template A4 Letter PDF Etsy

How To Create A Biweekly Budget In 5 Simple Steps FinancialEdge Credit Union