Managing your business finances can be a daunting task, but having a monthly budget template can make it a whole lot easier. By tracking your expenses and income each month, you can stay on top of your financial goals and make informed decisions for your business.

Whether you’re a small business owner or a freelancer, having a monthly business budget template can help you plan for the future and avoid any financial surprises. With a clear overview of your finances, you can prioritize your spending, identify areas where you can cut costs, and set realistic financial goals.

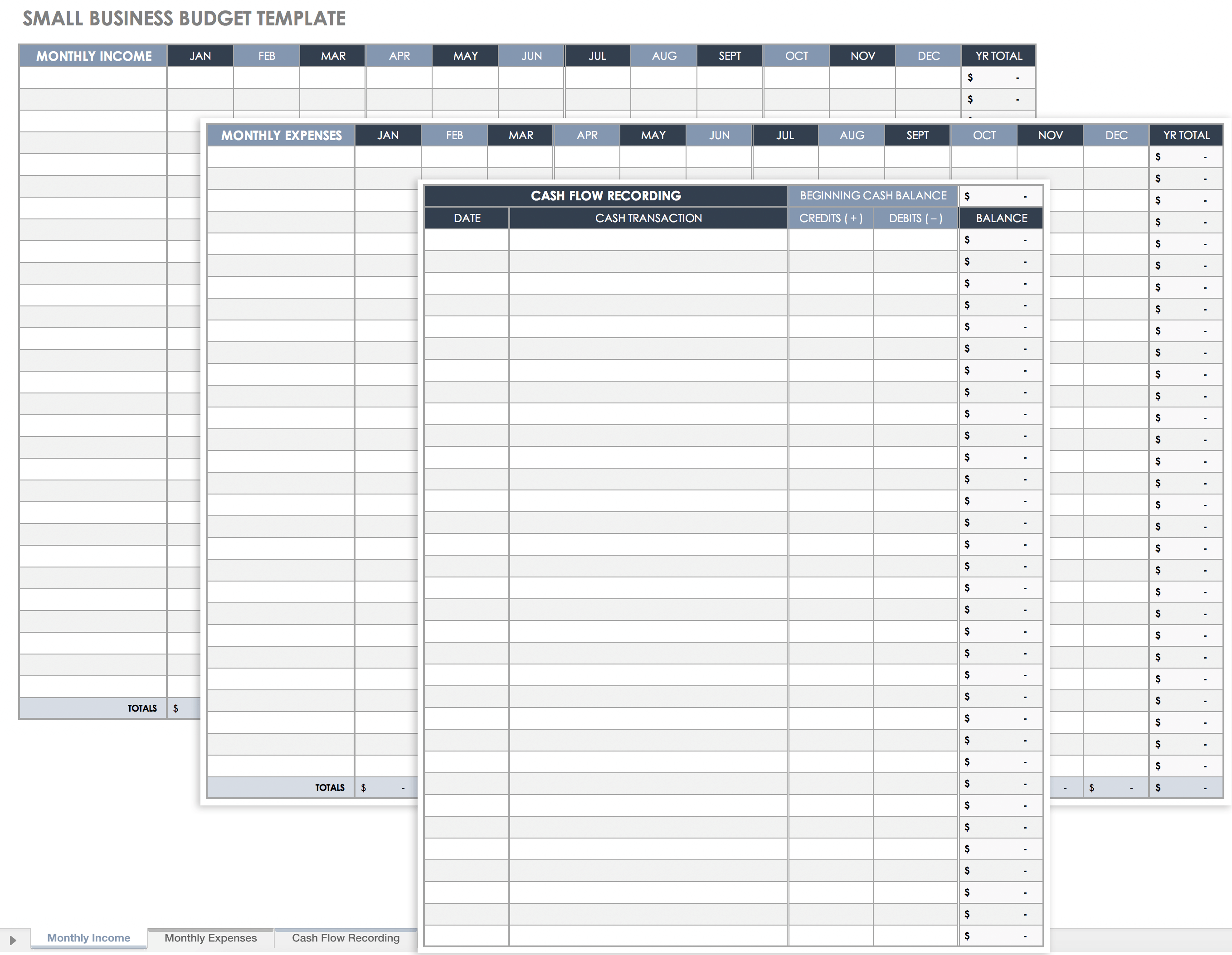

Monthly Business Budget Template

Monthly Business Budget Template

When creating a monthly business budget template, be sure to include all your sources of income, such as sales revenue, investments, and any other sources of revenue. Next, list all your expenses, including rent, utilities, salaries, and any other recurring costs.

Don’t forget to factor in unexpected expenses and savings goals when creating your budget template. This will help you prepare for any financial emergencies and ensure you’re building a solid financial foundation for your business.

By using a monthly business budget template, you can track your spending, monitor your cash flow, and make informed decisions about your business finances. With a clear picture of your financial health, you can set realistic goals and take proactive steps to grow your business.

Take the time to create a monthly business budget template that works for you and your business. With a little bit of effort and organization, you can take control of your finances and set yourself up for success in the long run.

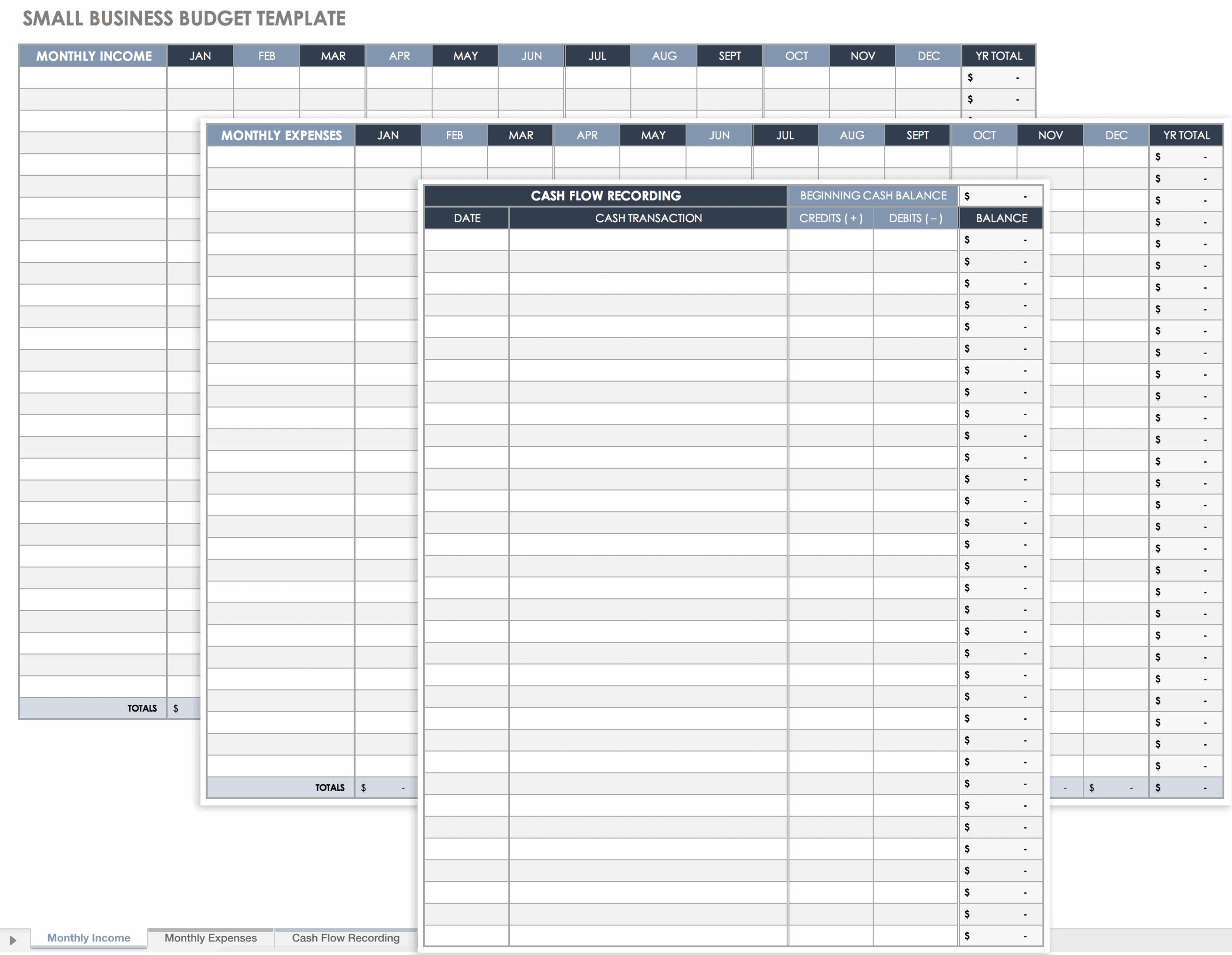

Free Small Business Budget Templates Smartsheet

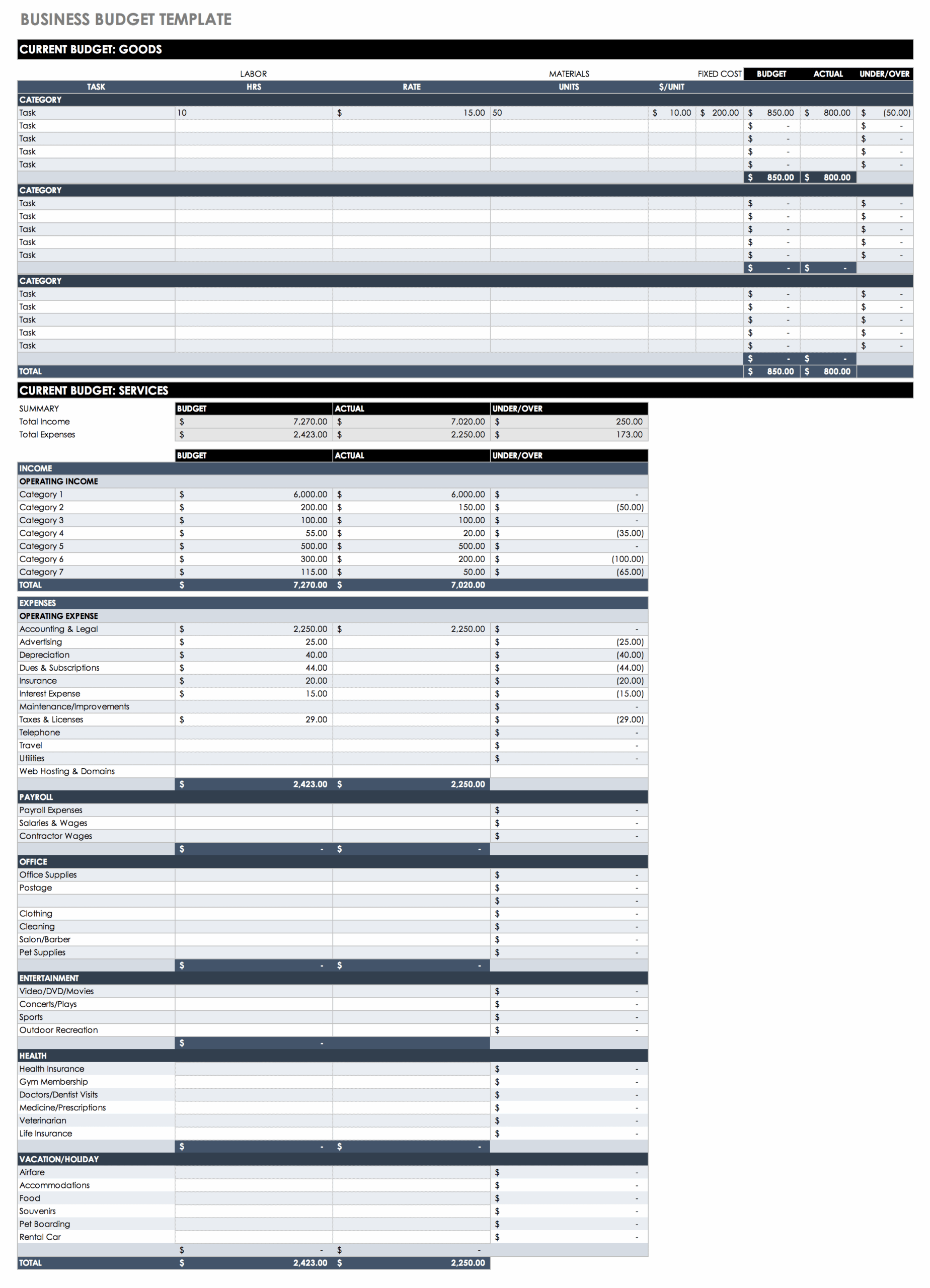

49 Handy Business Budget Templates Excel Google Sheets Word

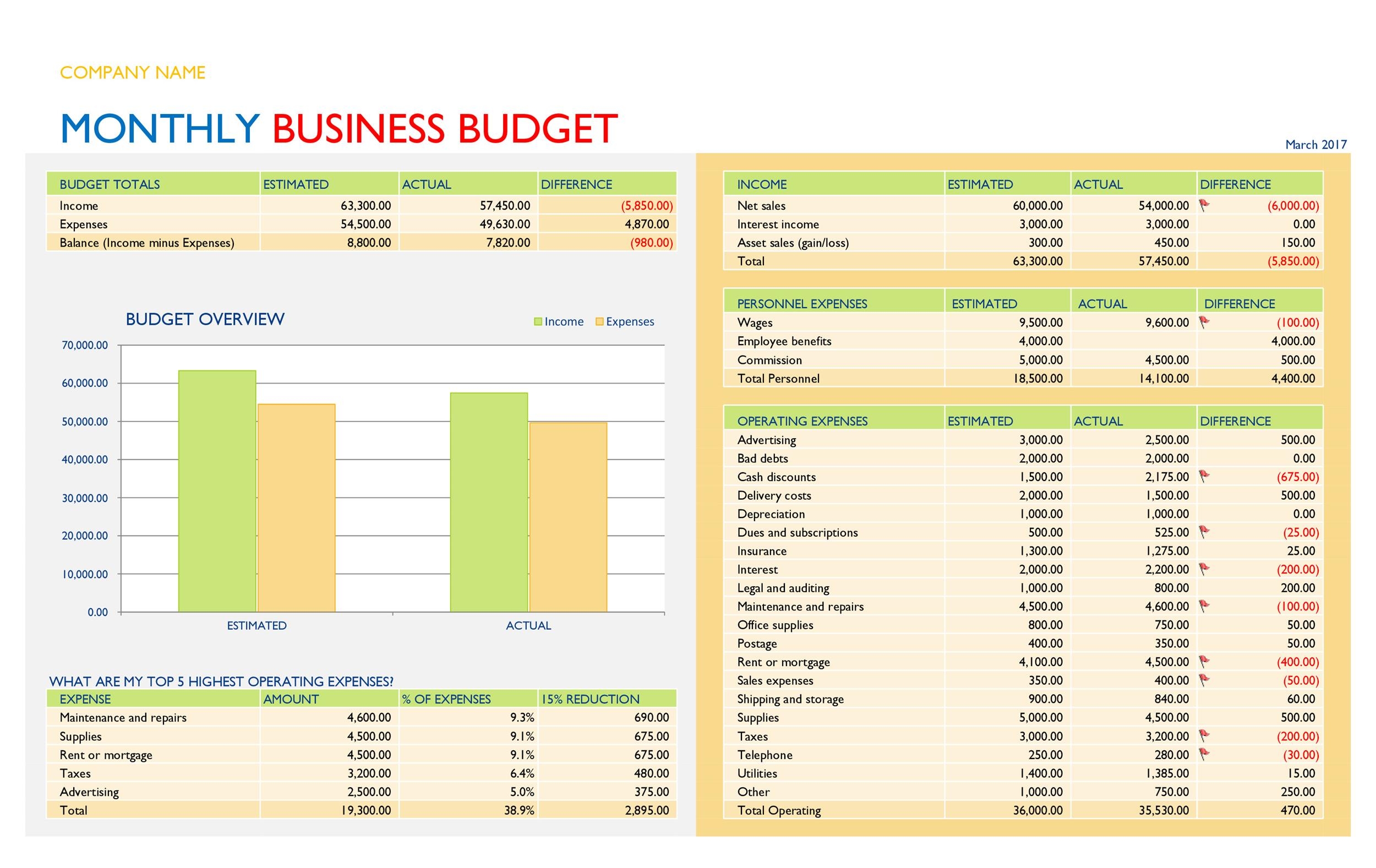

49 Handy Business Budget Templates Excel Google Sheets Word

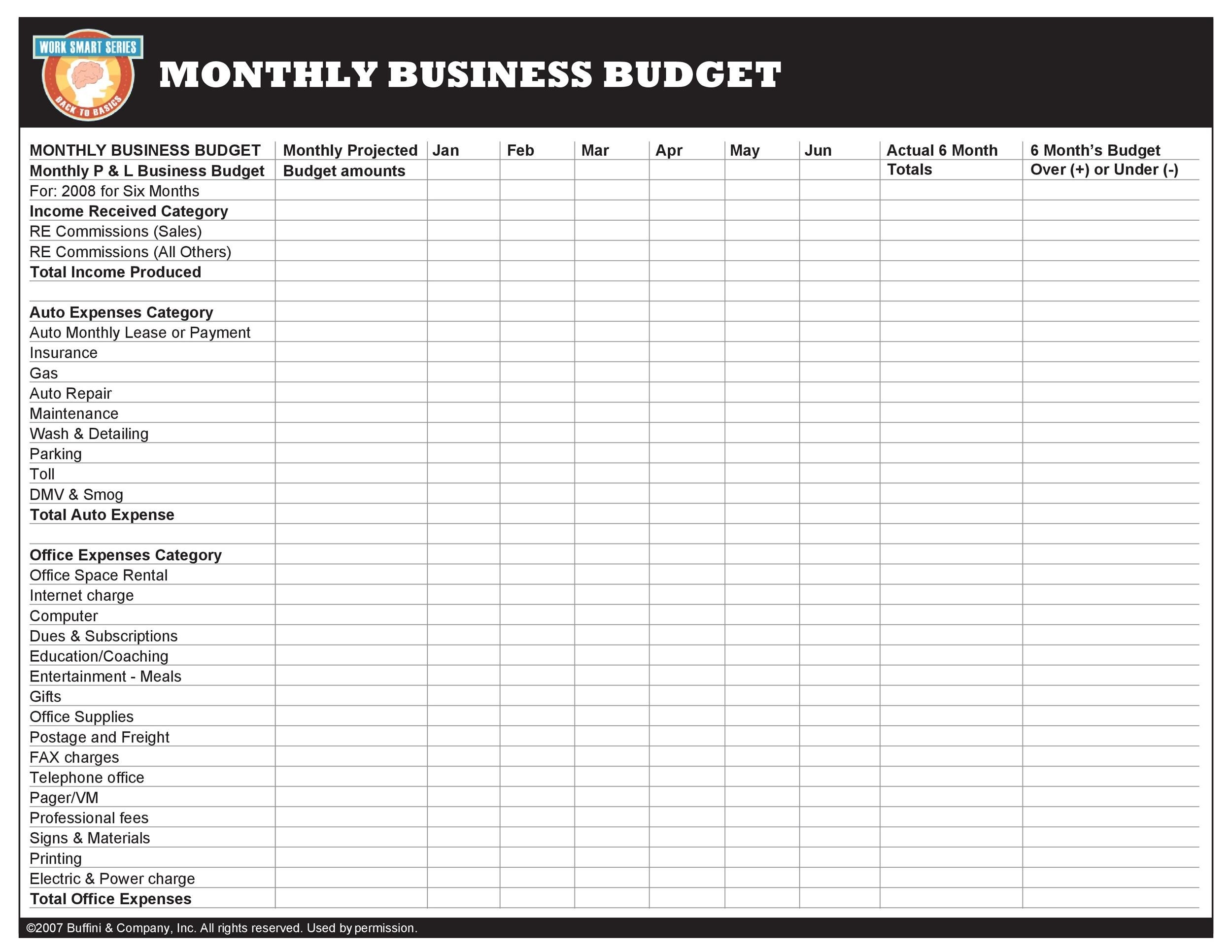

49 Handy Business Budget Templates Excel Google Sheets Word