Managing your finances can be overwhelming, but having a liquidity budget template can make it easier to track your expenses and savings. By creating a simple budget, you can take control of your money and make informed financial decisions.

Whether you’re saving for a big purchase or trying to get out of debt, a liquidity budget template can help you stay on track. With categories for income, expenses, and savings, you can see where your money is going and make adjustments as needed.

Liquidity Budget Template

Liquidity Budget Template: A Simple Tool for Financial Management

When creating your liquidity budget template, start by listing all your sources of income. This can include your salary, side hustle earnings, or any other money coming in each month. Next, list all your expenses, such as rent, utilities, groceries, and entertainment.

Once you have your income and expenses laid out, subtract your expenses from your income to see how much money you have left over. This amount can go towards savings, debt repayment, or any other financial goals you have. By keeping track of your finances with a liquidity budget template, you can make sure you’re staying within your means and working towards your financial goals.

In conclusion, a liquidity budget template is a valuable tool for managing your finances and reaching your financial goals. By creating a simple budget and tracking your income and expenses, you can take control of your money and make informed decisions about your financial future.

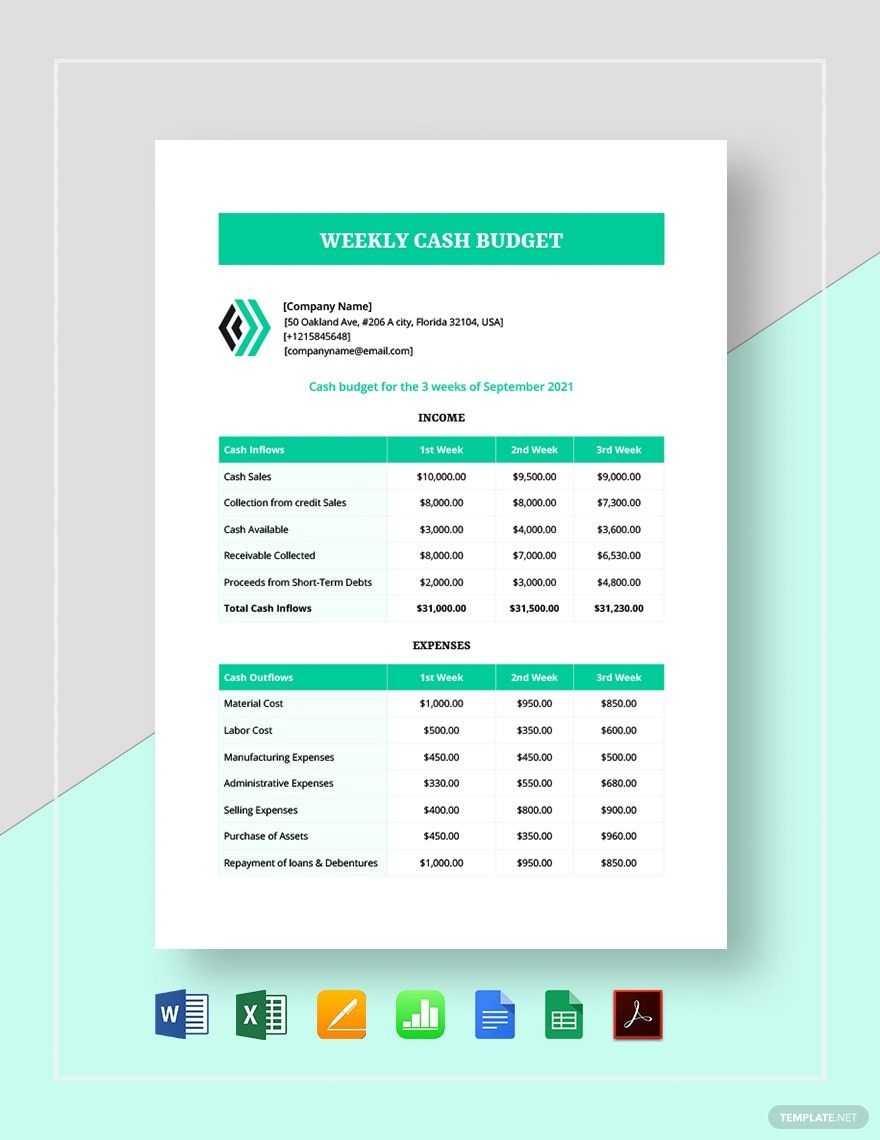

Weekly Cash Budget Template In Google Docs Google Sheets Excel

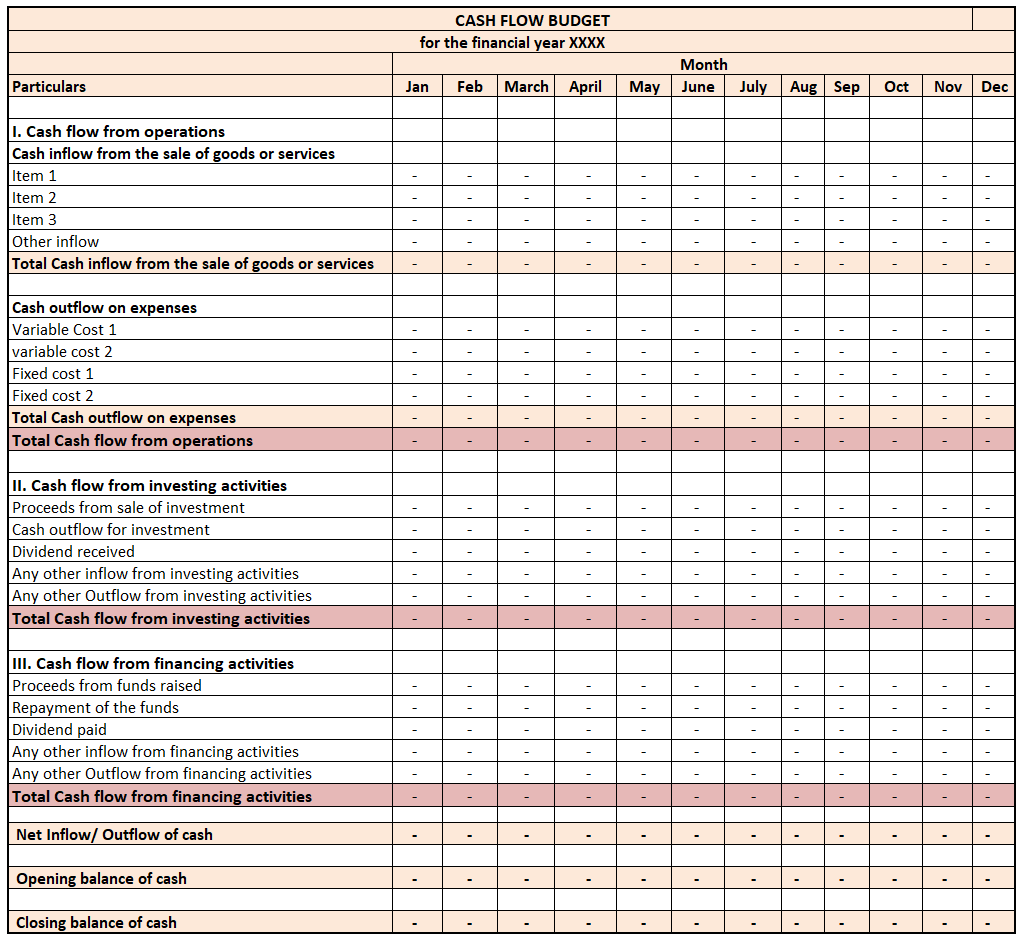

Cash Budget What Is It Format Example How To Prepare

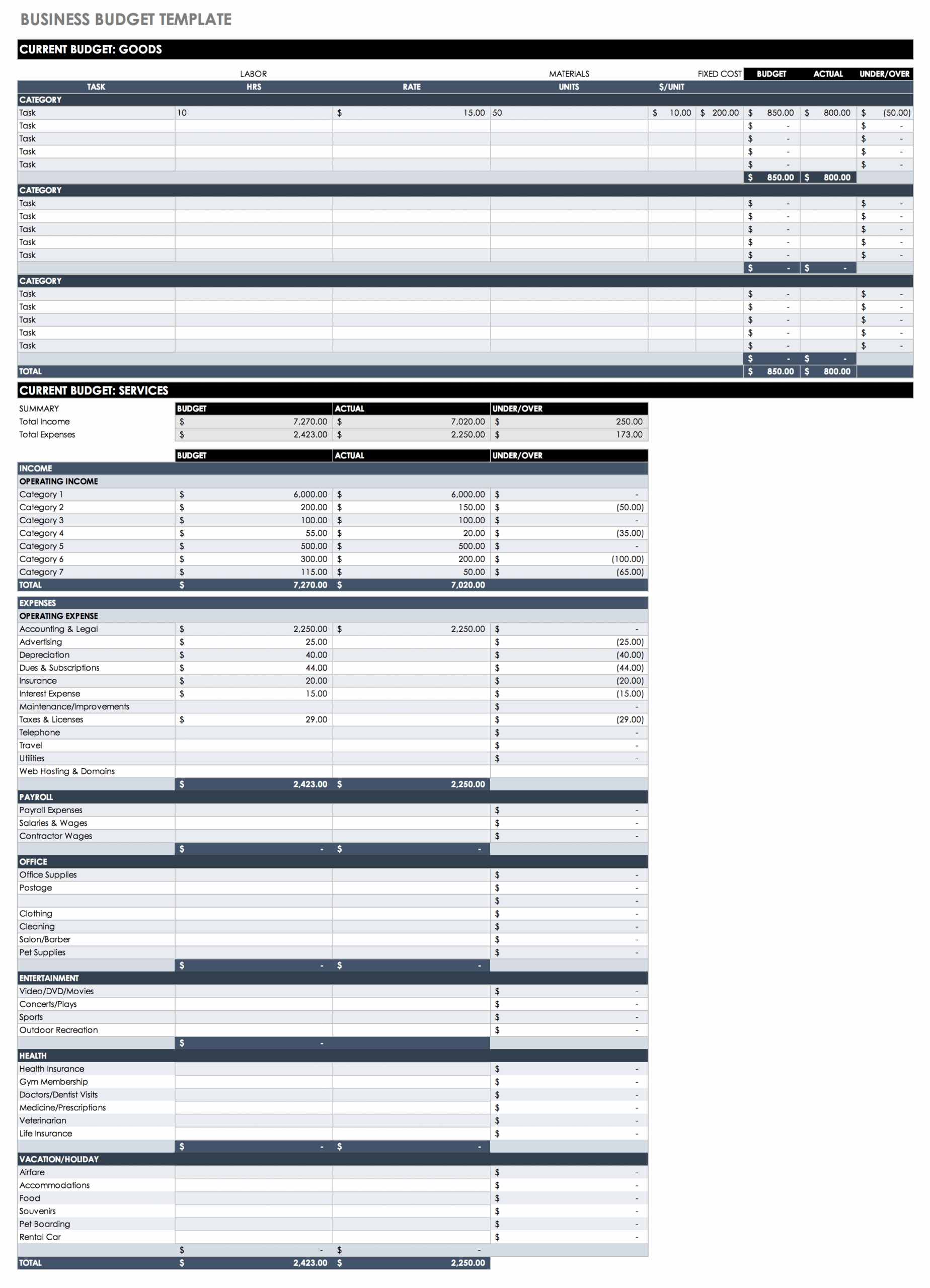

6 Easy Steps To Create Cash Budget For Your Business

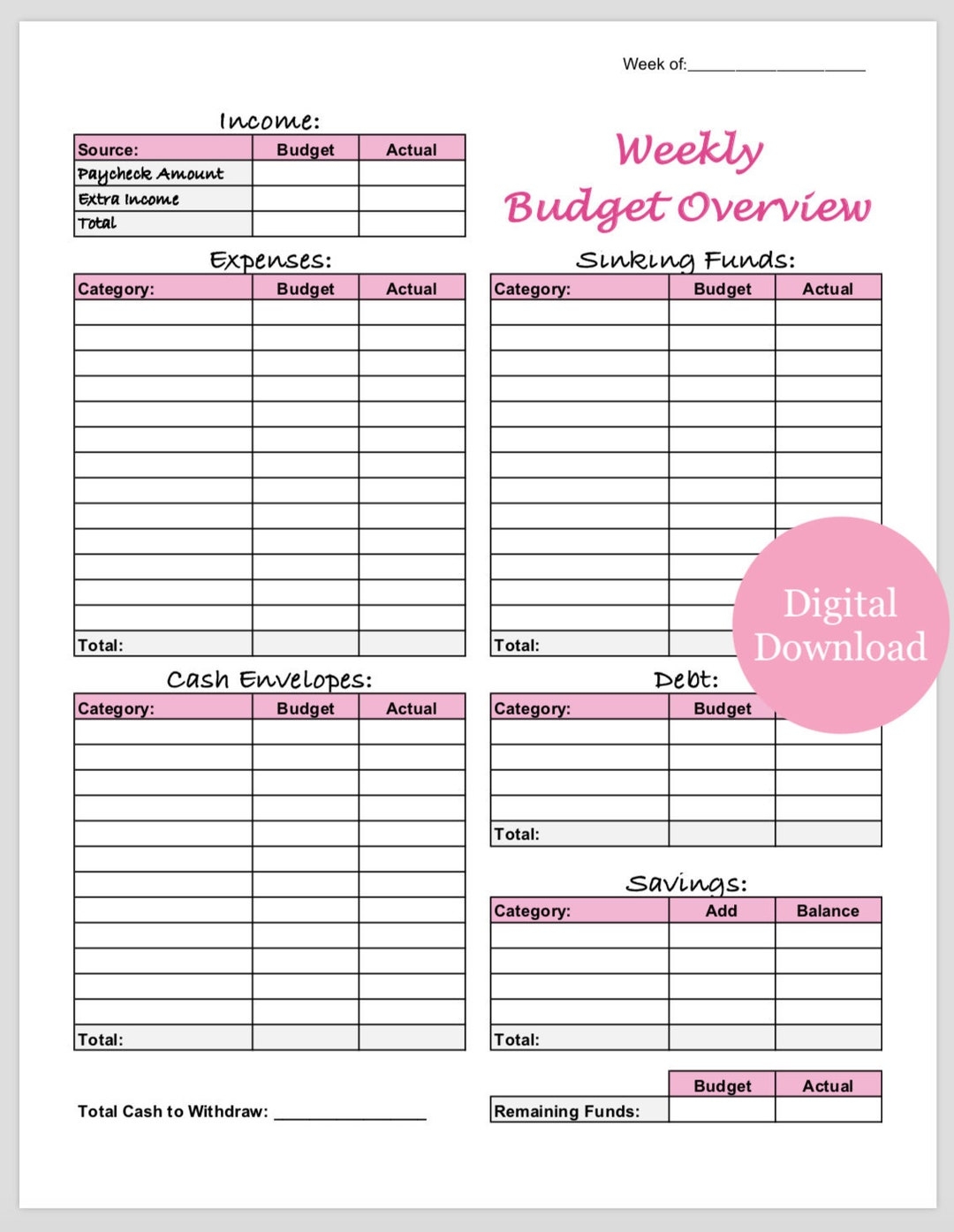

Weekly Budget Template Printable For Cash Envelopes And Sinking Funds pink Etsy

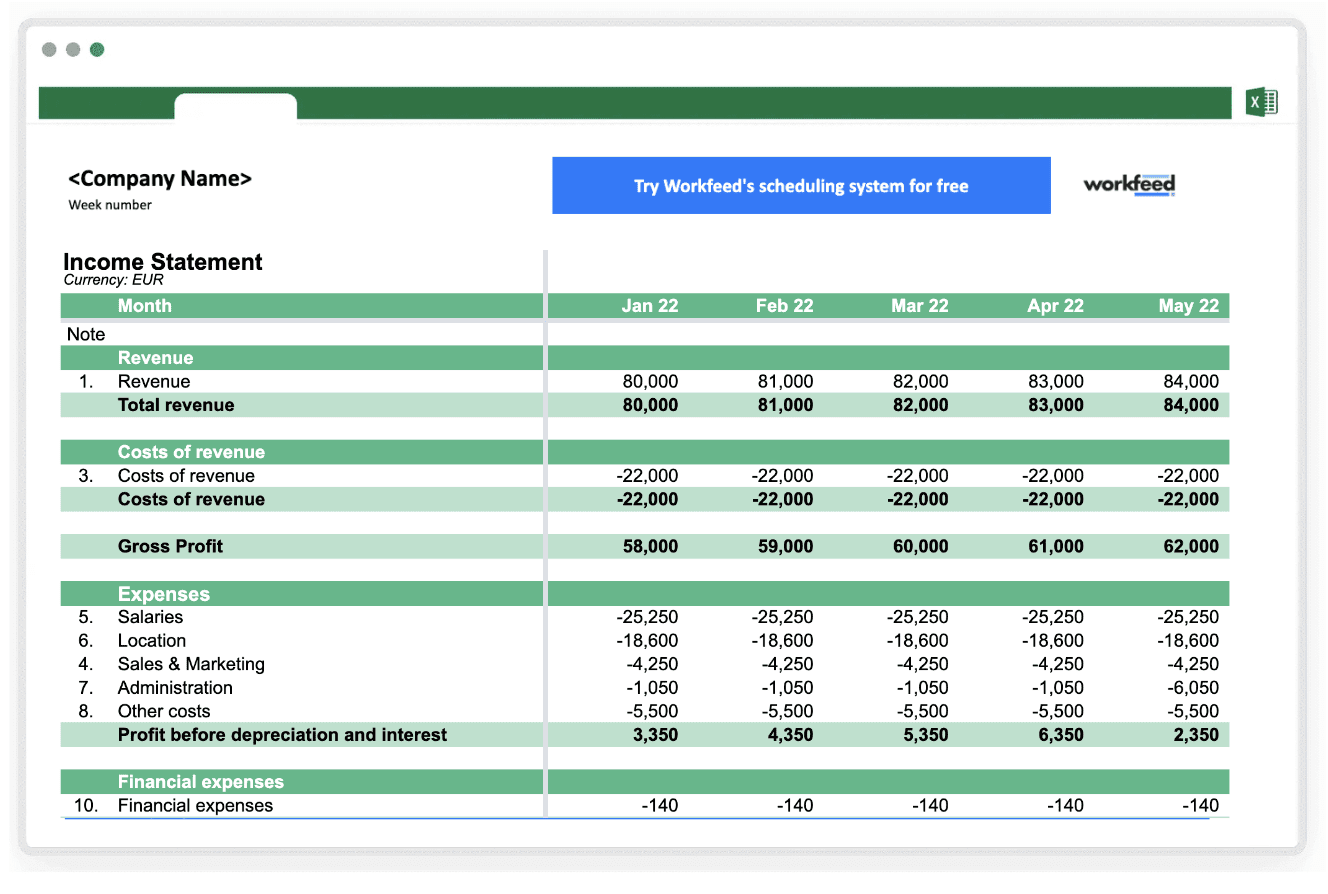

Free Excel Business Budget Template Workfeed