Managing your finances can be tricky, especially when dealing with a declining budget. It’s crucial to have a solid budget template in place to help you stay on track and make the most of your money.

Whether you’re a student, a small business owner, or just trying to save more, having a reliable budget template can make all the difference. By tracking your expenses and income, you can easily see where your money is going and make adjustments as needed.

Declining Budget Template

Declining Budget Template: Why You Need One

A declining budget template allows you to plan for the future, anticipate potential financial challenges, and make informed decisions about your spending. It gives you a clear picture of your financial health and helps you prioritize your expenses.

With a declining budget template, you can set realistic financial goals, track your progress, and make adjustments as needed. It provides a roadmap for your financial future and empowers you to take control of your money.

Don’t let a declining budget stress you out. By using a budget template, you can take charge of your finances and make smart choices that will benefit you in the long run. Start today and see the positive impact it can have on your financial well-being.

In conclusion, a declining budget template is a valuable tool that can help you navigate financial challenges and make the most of your money. Take the time to create a budget template that works for you and watch as your financial situation improves. Remember, it’s never too late to start managing your money wisely.

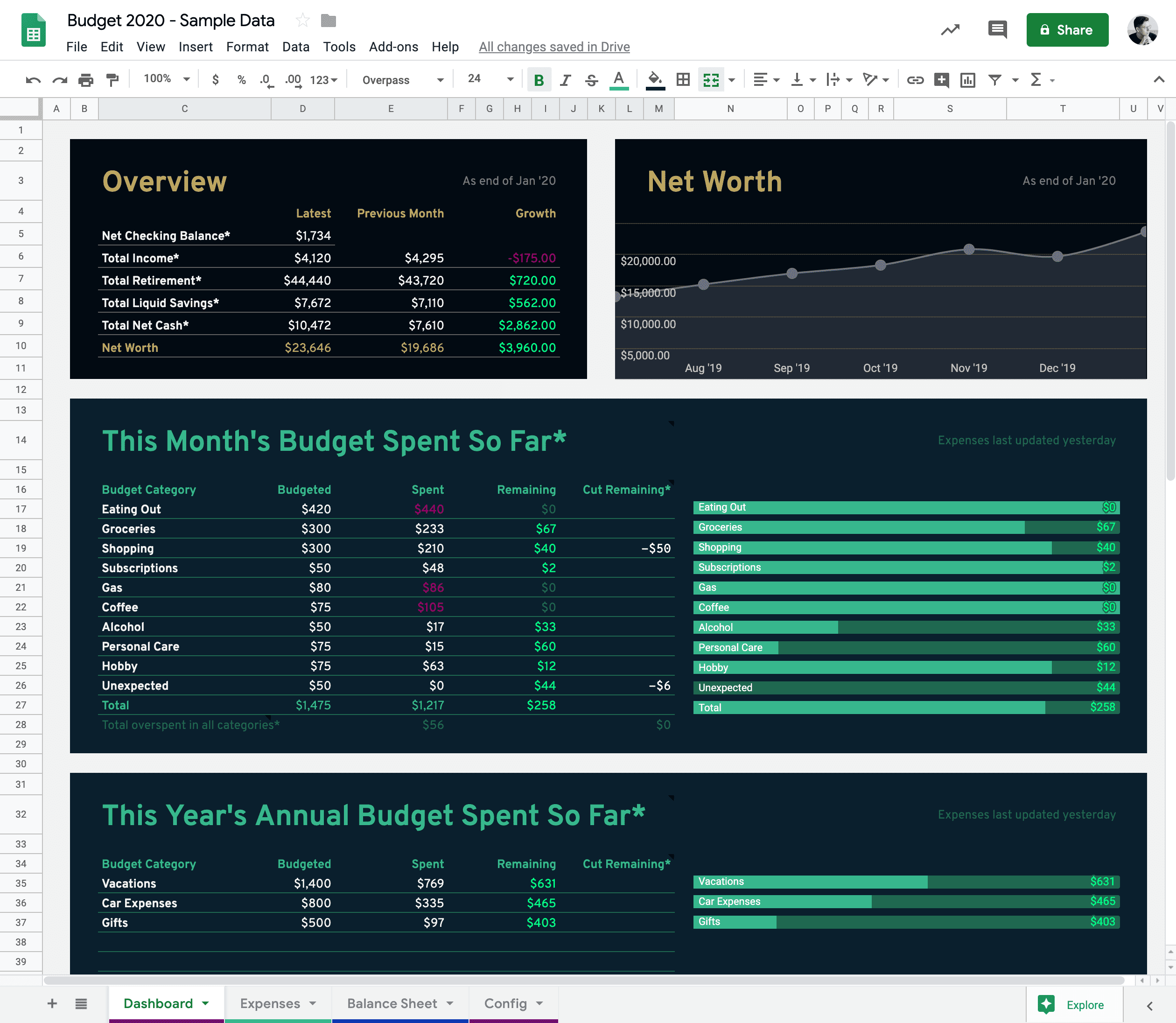

Need A Google Sheets Budget Template Here Are 12 Of The Best

My Google Sheets Budget Template for Millennials Regpaq

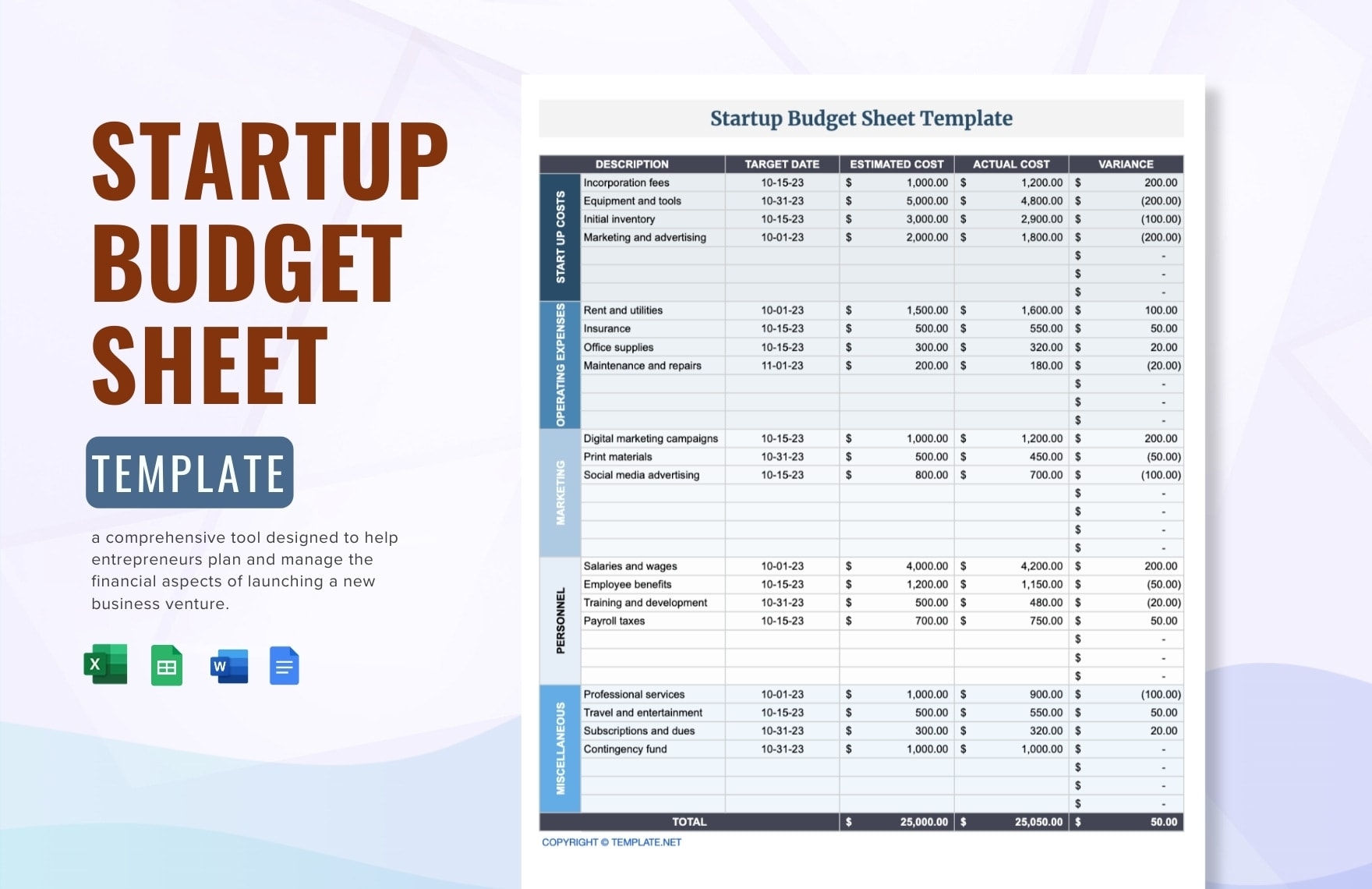

Free Budgeting Spreadsheets To Help Create U0026 Follow A Budget

My Google Sheets Budget Template for Millennials Regpaq

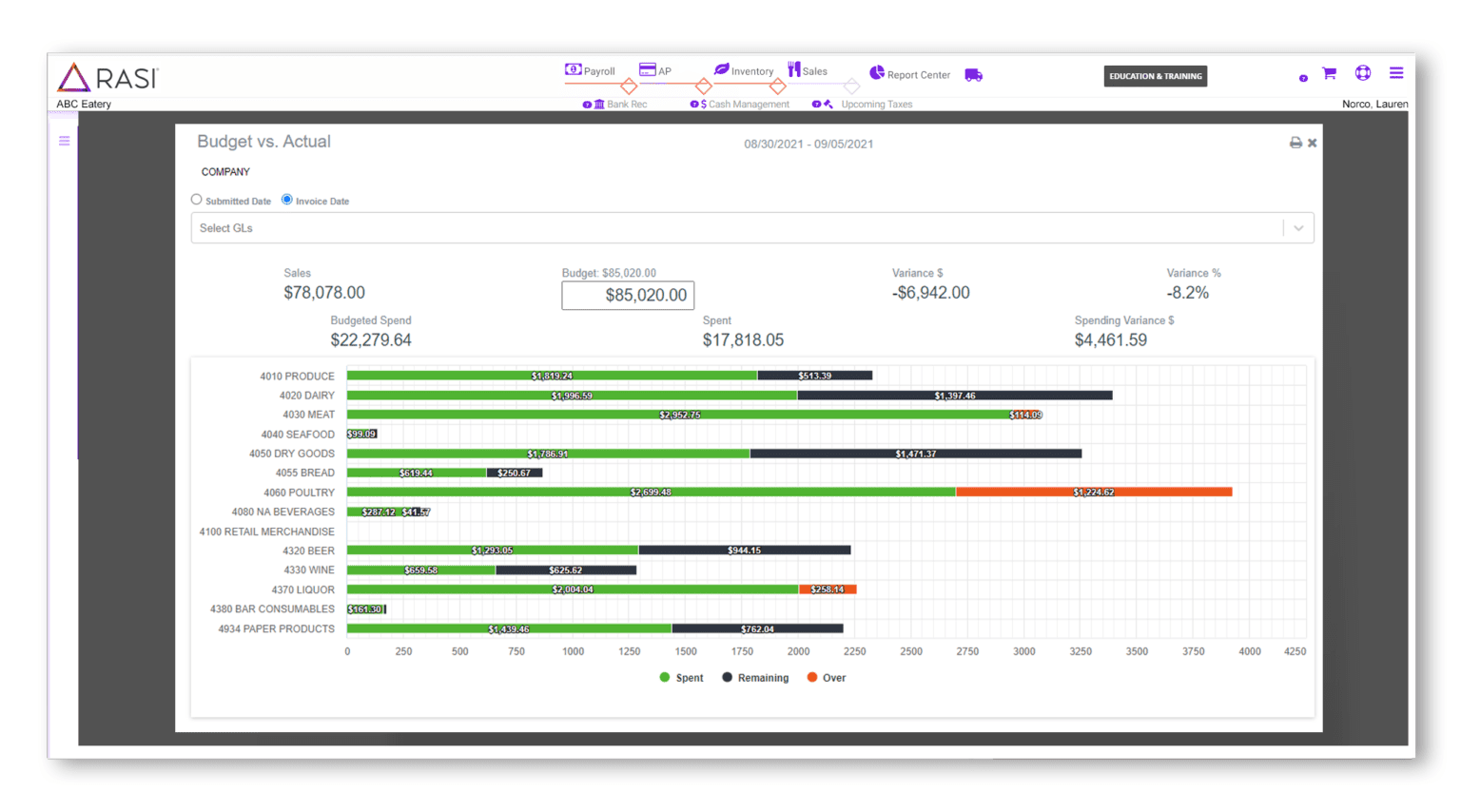

How To Use A Declining Budget Food Cost Management Tips