Managing your finances can be overwhelming, especially when dealing with debt. Creating a debt repayment budget template can help you take control of your financial situation and work towards becoming debt-free.

By having a structured plan in place, you can track your income, expenses, and debt payments more effectively. This template will guide you on how to allocate your funds towards paying off your debts while still covering your essential expenses.

Debt Repayment Budget Template

Debt Repayment Budget Template

Start by listing all your sources of income for the month. This includes your salary, side hustle earnings, or any other money you receive. Next, jot down all your fixed expenses like rent, utilities, groceries, and transportation costs.

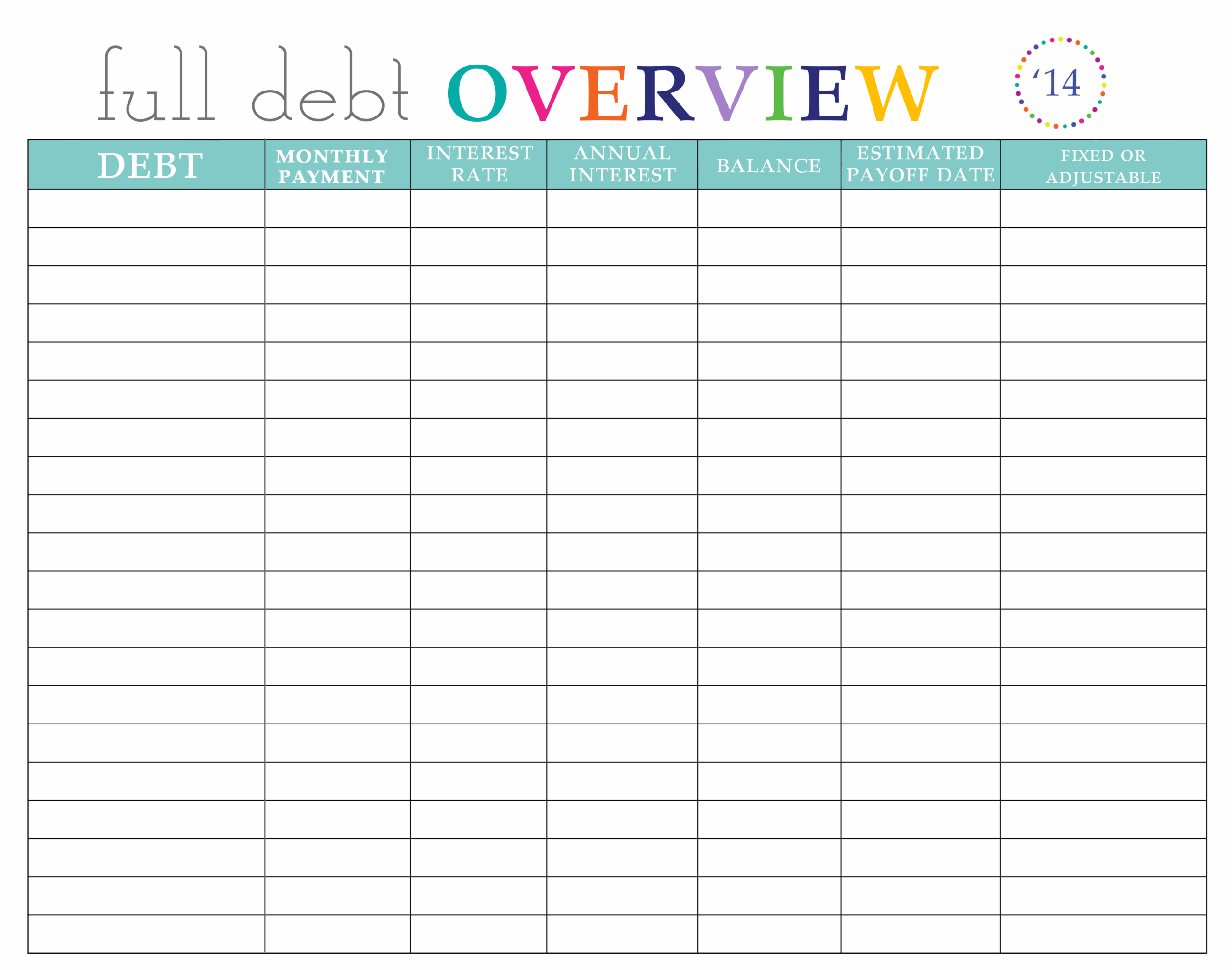

Once you have a clear picture of your income and expenses, identify how much you can allocate towards debt repayment. List all your debts, including credit cards, loans, and any other outstanding balances. Prioritize paying off high-interest debts first while making minimum payments on others.

Adjust your budget as needed to ensure you’re on track to meet your debt repayment goals. Cut back on non-essential expenses and look for ways to increase your income if possible. Stay committed to your budget and monitor your progress regularly to stay motivated.

Creating a debt repayment budget template is a proactive step towards achieving financial freedom. With dedication and discipline, you can take charge of your finances, pay off your debts, and work towards a more secure financial future.

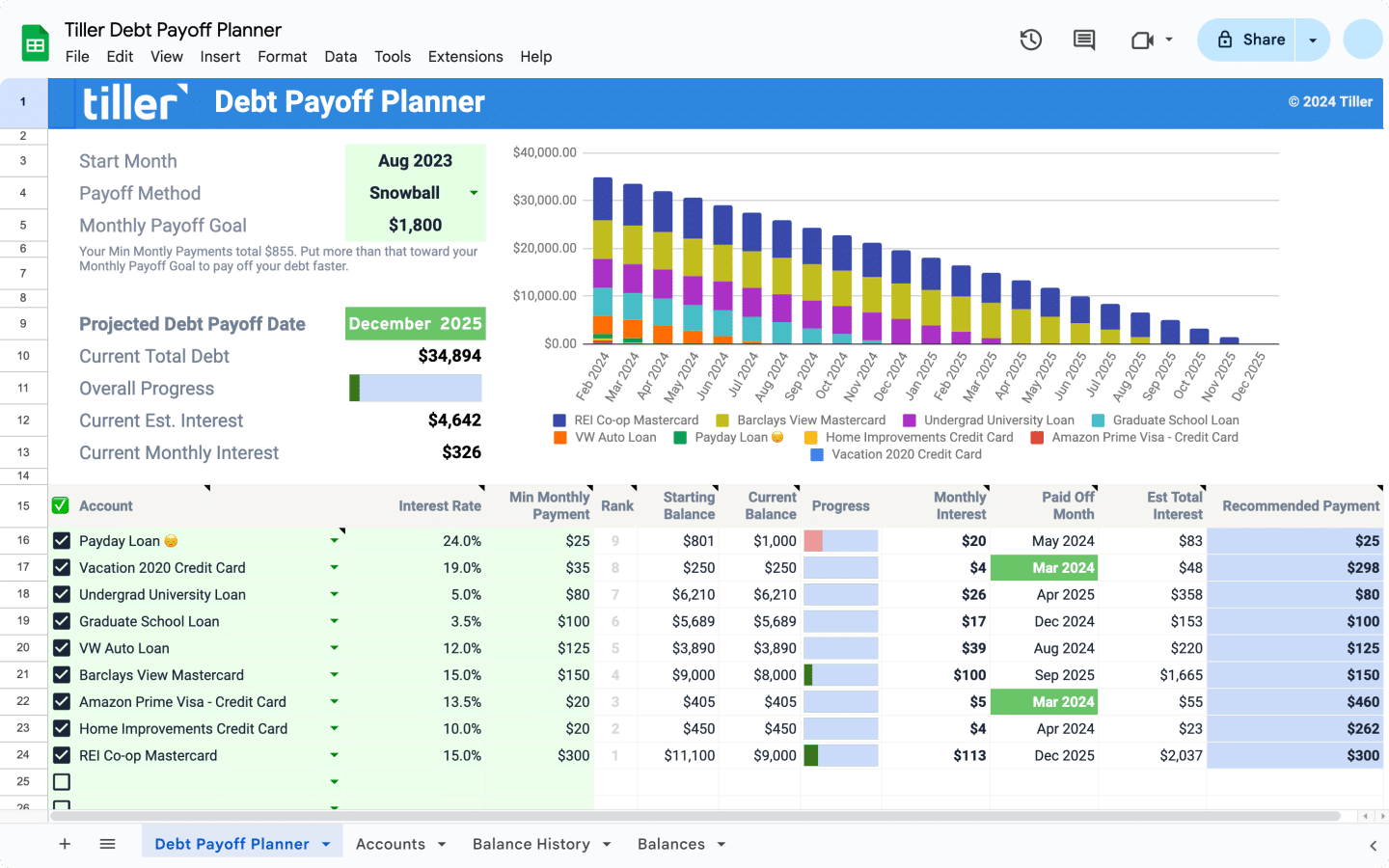

Introducing The New Tiller Debt Payoff Planner Spreadsheet News

Paying Off Debt Worksheets

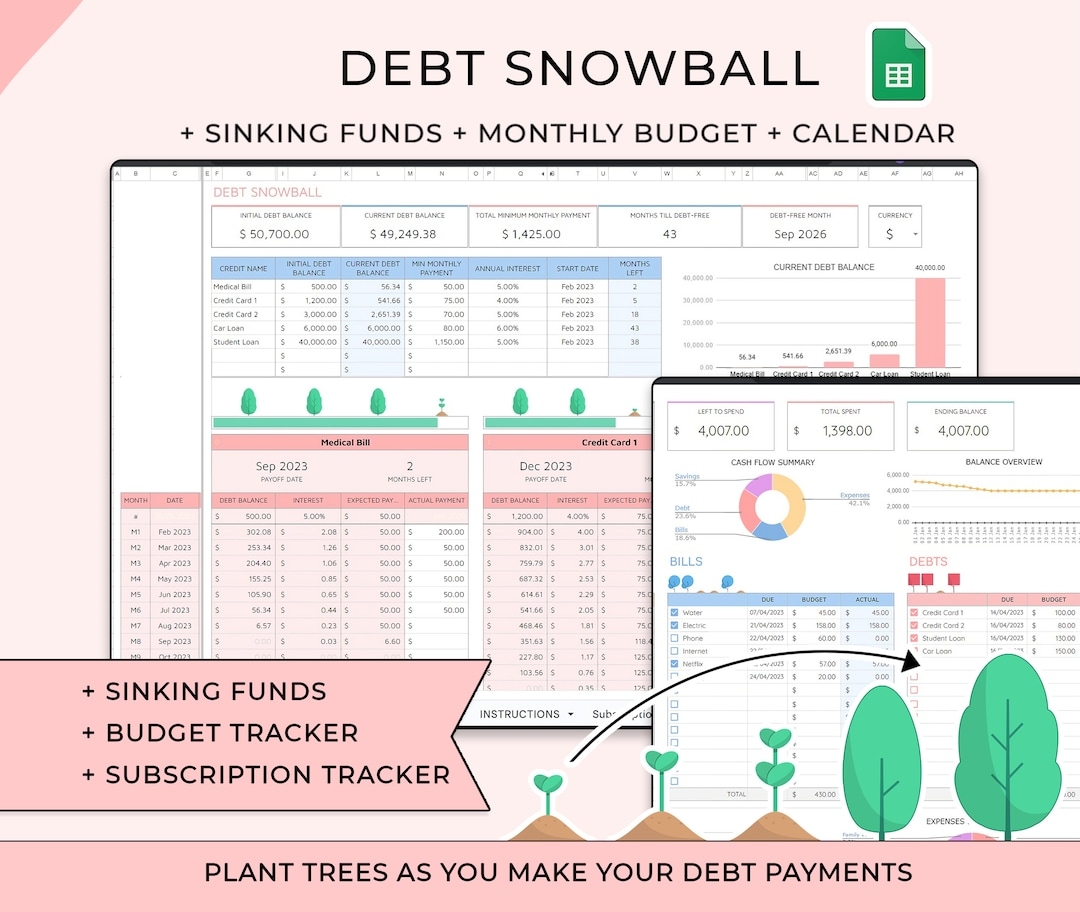

38 Debt Snowball Spreadsheets Forms U0026 Calculators

New Excel Debt Payoff Planner And Tracker The Happy Giraffe

Debt Payoff U0026 Monthly Budget Tracker Google Sheets Debt Snowball Spreadsheet Bill Debt Tracker And Budget Planner Paycheck Budget Sheet Etsy