Are you feeling overwhelmed by your debt and not sure where to start? Don’t worry, we’ve got you covered! With the right budget template, you can take control of your finances and start paying off your debt.

Creating a budget is the first step towards financial freedom. By tracking your income and expenses, you can identify areas where you can cut back and put more money towards paying off your debt. It’s all about prioritizing your financial goals and making a plan to achieve them.

Budget Template To Pay Off Debt

Budget Template To Pay Off Debt

One of the most effective budget templates for paying off debt is the 50/30/20 rule. This rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. By following this guideline, you can strike a balance between enjoying life and working towards a debt-free future.

Another popular budget template is the zero-based budget. With this approach, every dollar of your income is assigned a specific purpose, whether it’s paying bills, saving, or debt repayment. This method ensures that you make the most of your money and stay on track with your financial goals.

Remember, paying off debt is a journey that requires patience and dedication. It may not happen overnight, but with a solid budget template in place, you can make steady progress towards a debt-free life. Stay focused, stay motivated, and you’ll soon be on your way to financial freedom!

Ask Away Blog How To Create A Debt Pay Down Plan STICK TO IT

Paying Off Debt Worksheets

Paying Off Debt Worksheets

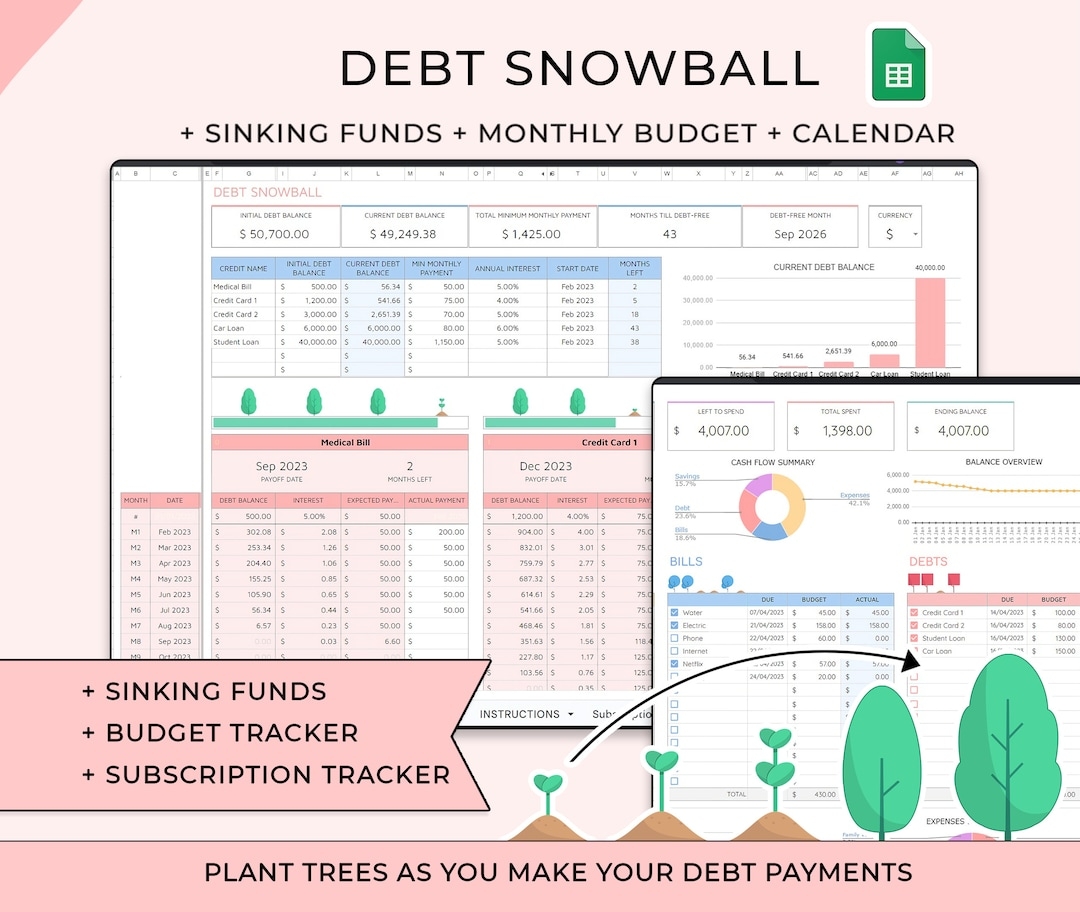

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Student

New Excel Debt Payoff Planner And Tracker The Happy Giraffe