Managing your finances can be stressful, especially when you’re paid biweekly. Keeping track of your expenses and income can be challenging, but using a budget template can help simplify the process.

A budget template for biweekly pay can provide a clear overview of your financial situation. It allows you to plan ahead, set financial goals, and track your spending to ensure you stay on track.

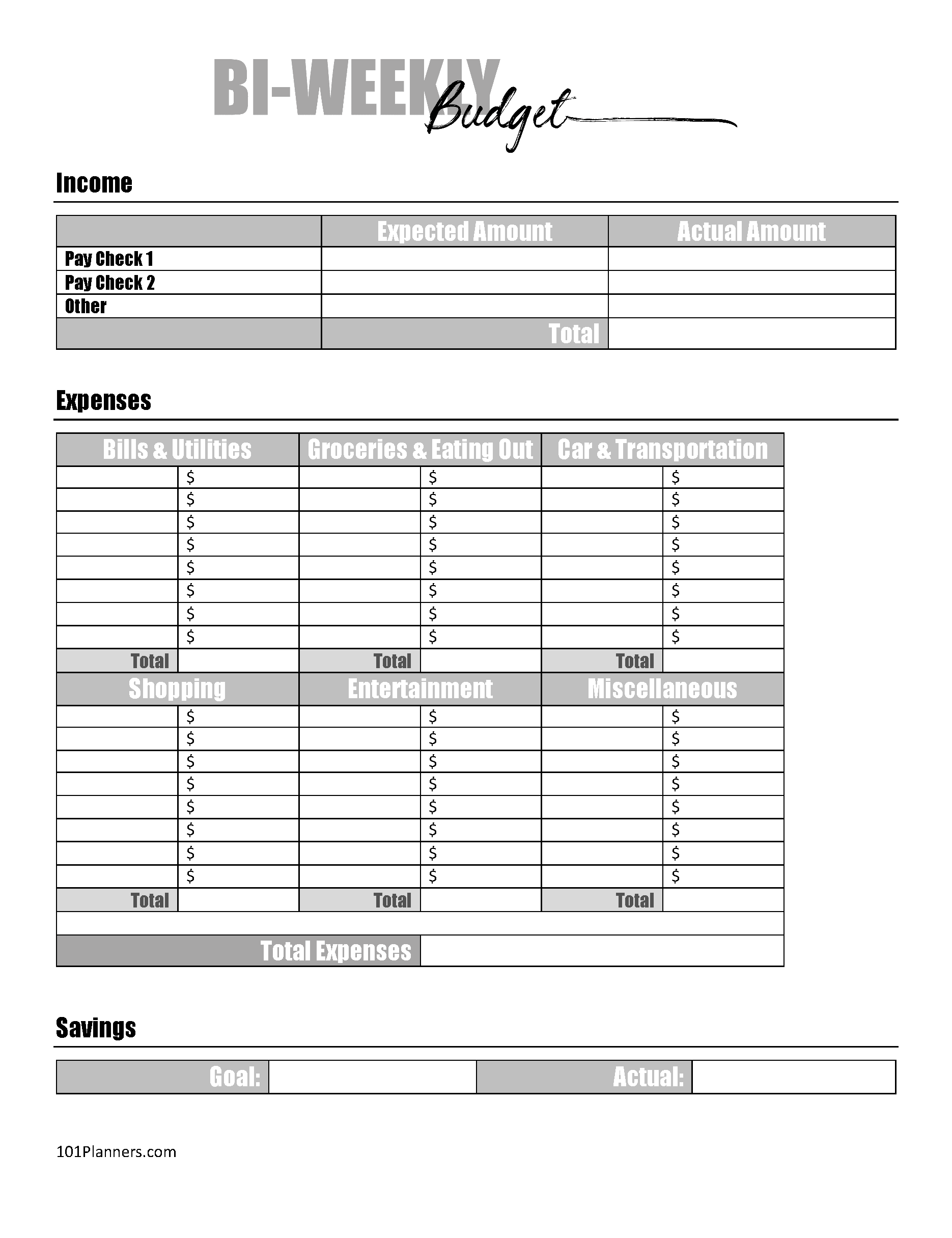

Budget Template For Biweekly Pay

Budget Template For Biweekly Pay

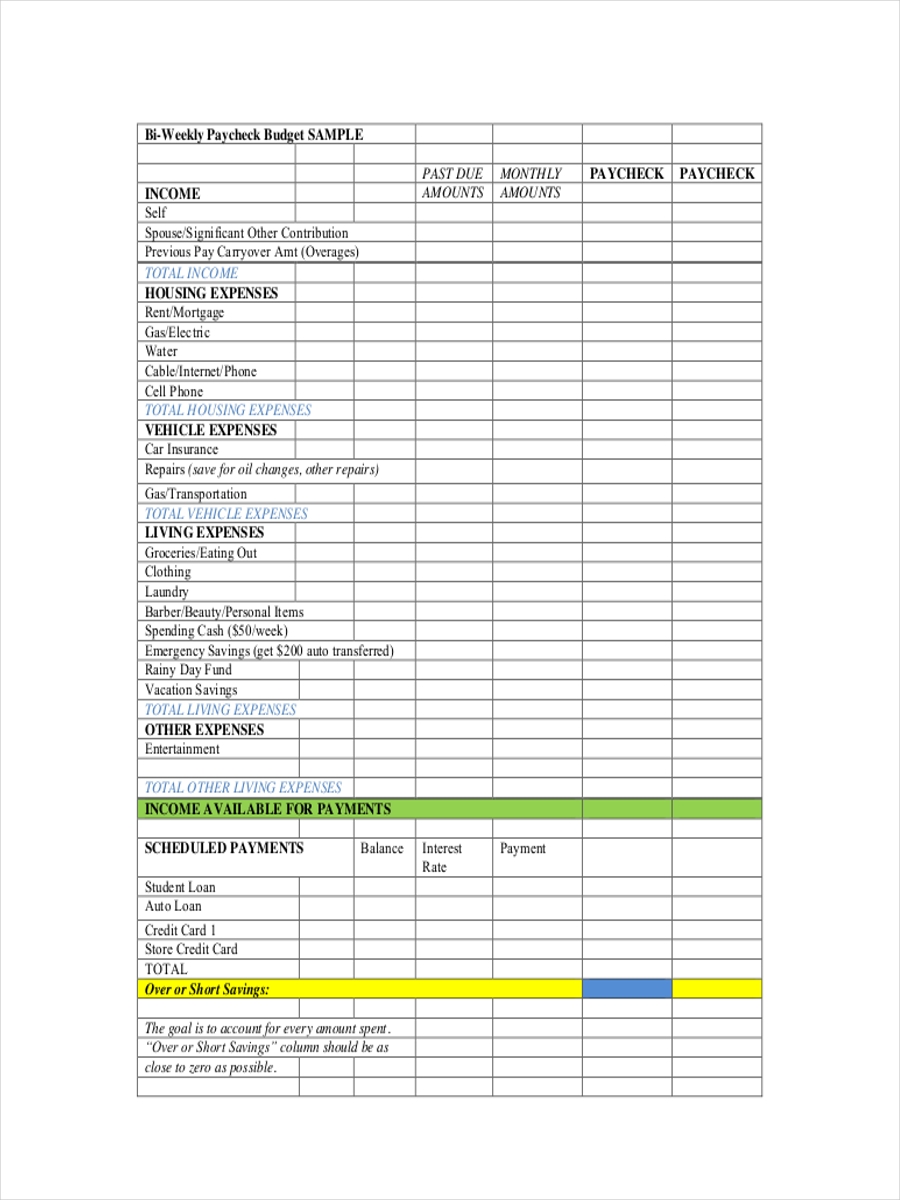

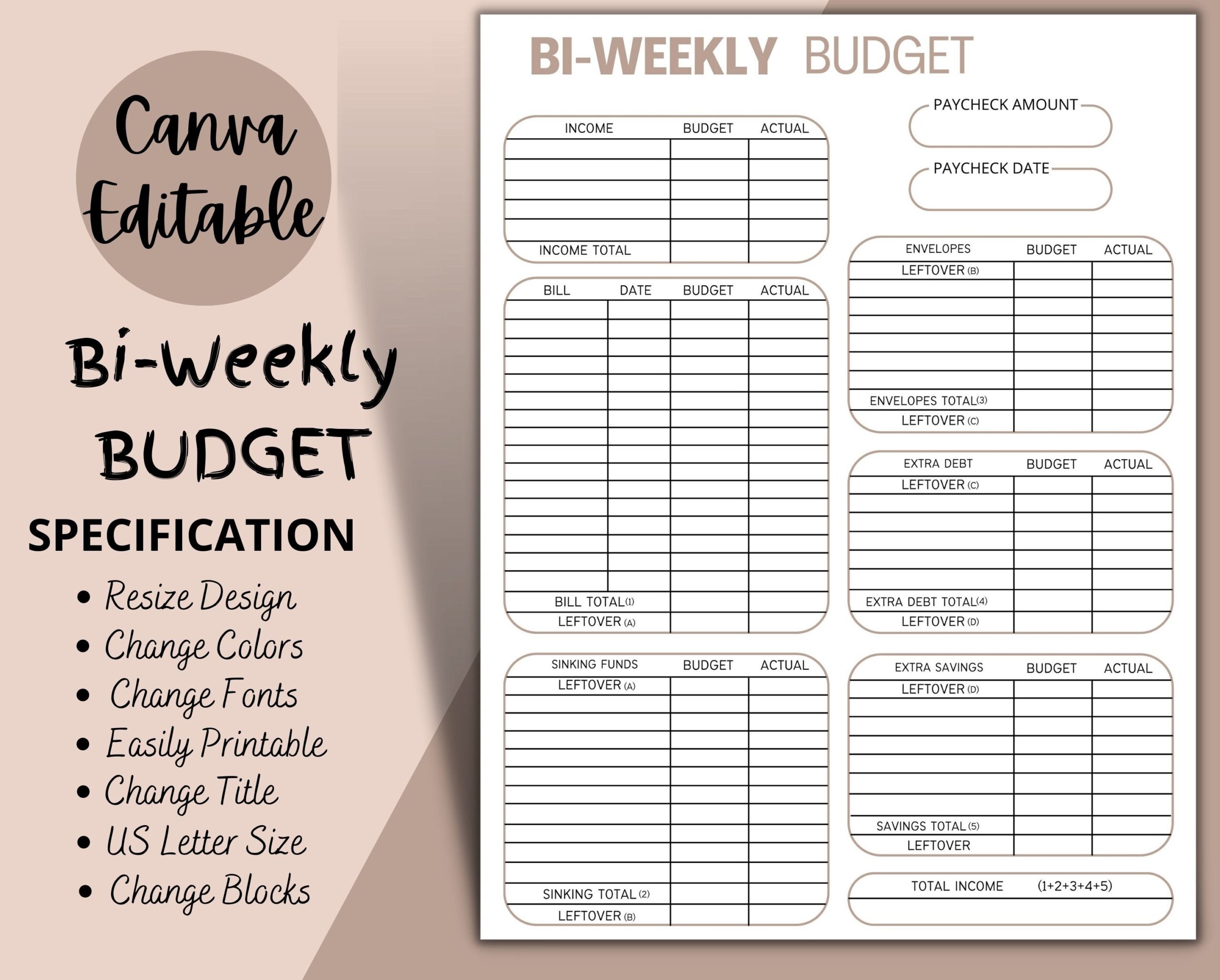

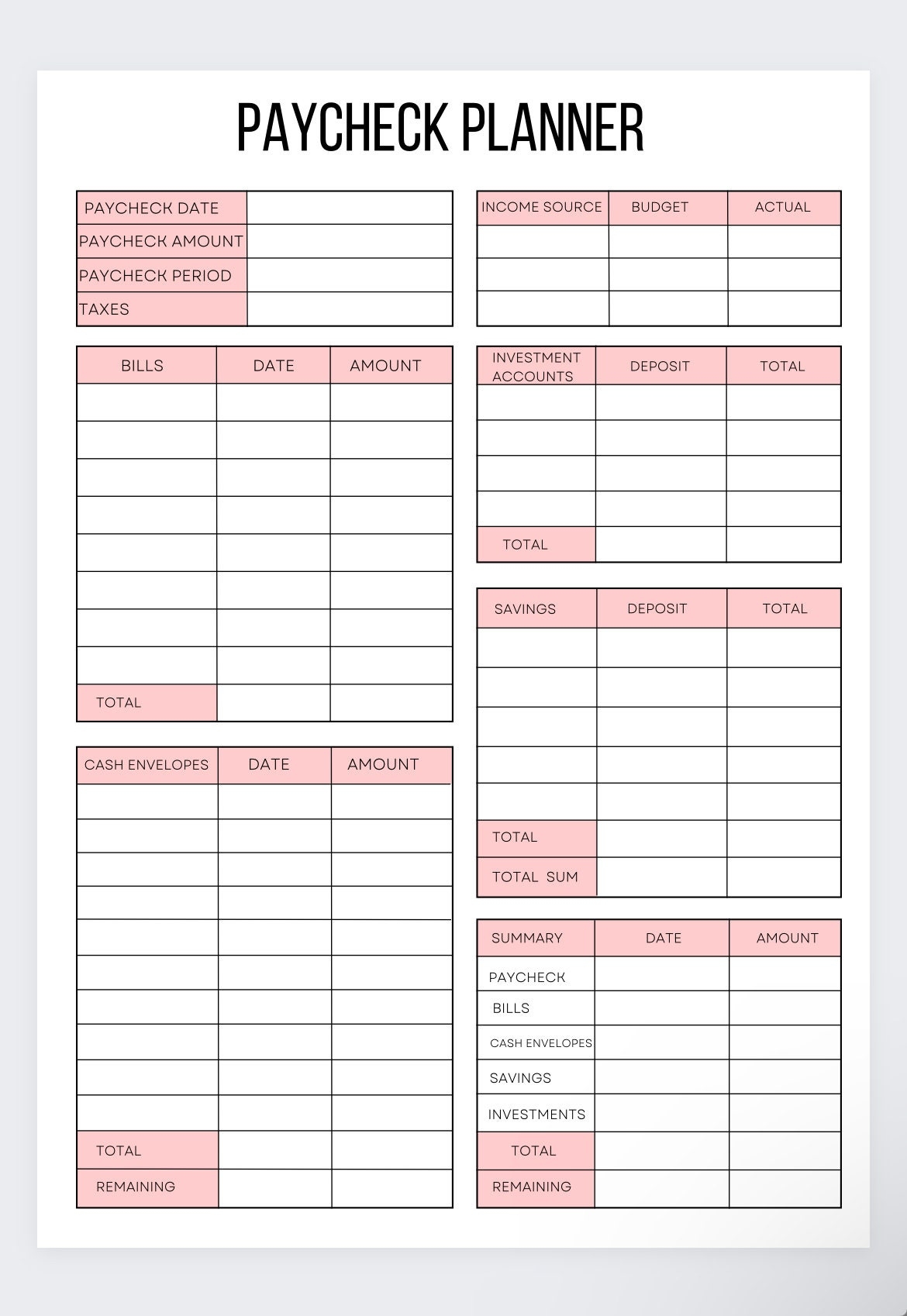

When creating a budget template for biweekly pay, start by listing all your sources of income. This includes your salary, any side hustle earnings, or passive income streams. Be sure to include the exact amounts and frequency of each source.

Next, list all your fixed expenses such as rent or mortgage, utilities, insurance, and loan payments. Then, factor in variable expenses like groceries, entertainment, and other discretionary spending. Assign a realistic amount to each category based on your past spending habits.

Once you’ve listed all your income and expenses, subtract your total expenses from your total income to determine if you have a surplus or a deficit. If you have a surplus, consider allocating it towards savings or debt repayment. If you have a deficit, look for areas where you can cut back on spending.

In conclusion, using a budget template for biweekly pay can help you take control of your finances and make informed decisions about your money. By tracking your income and expenses, you can work towards your financial goals and achieve greater financial stability.

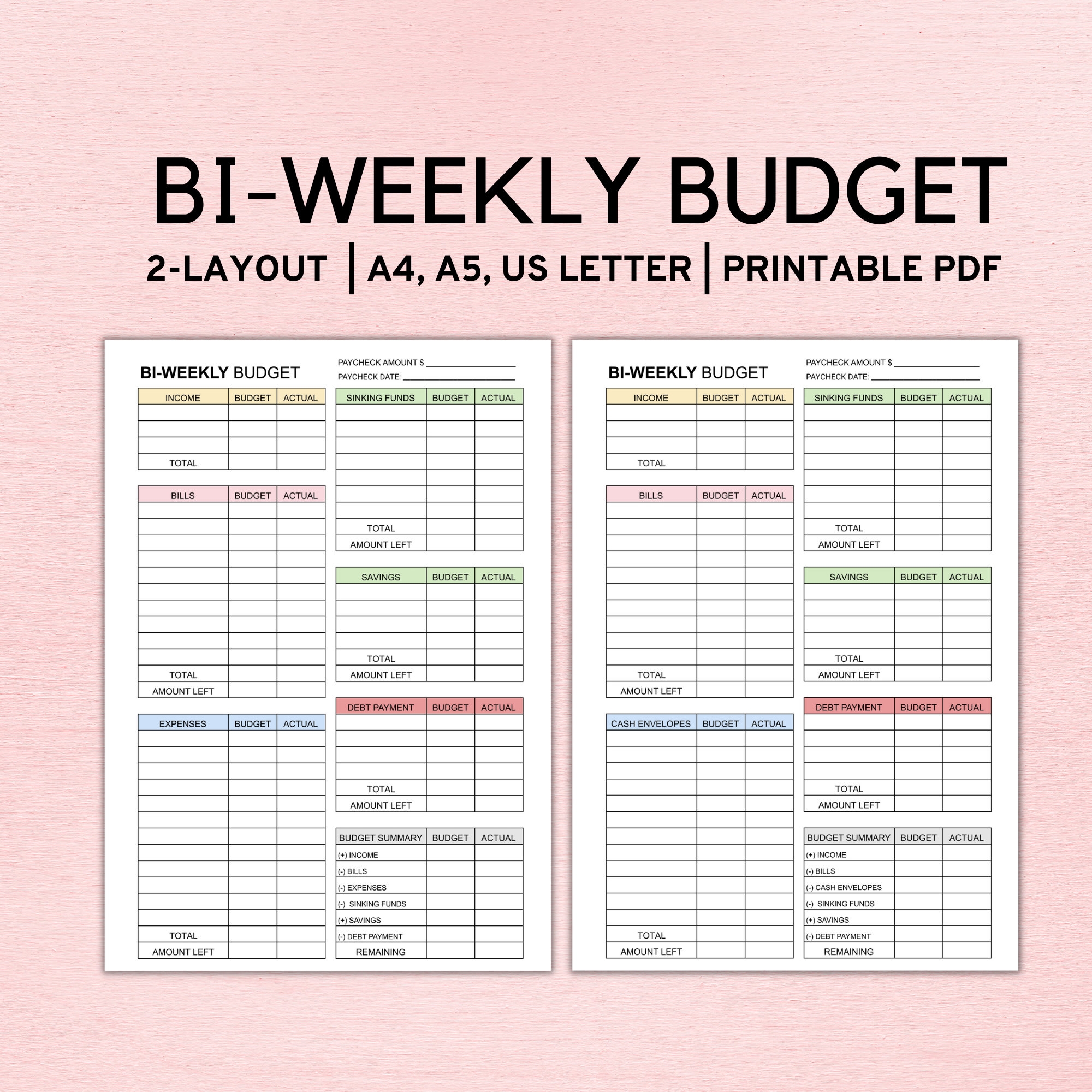

Bi weekly Budget Overview Template Printable Canva Editable

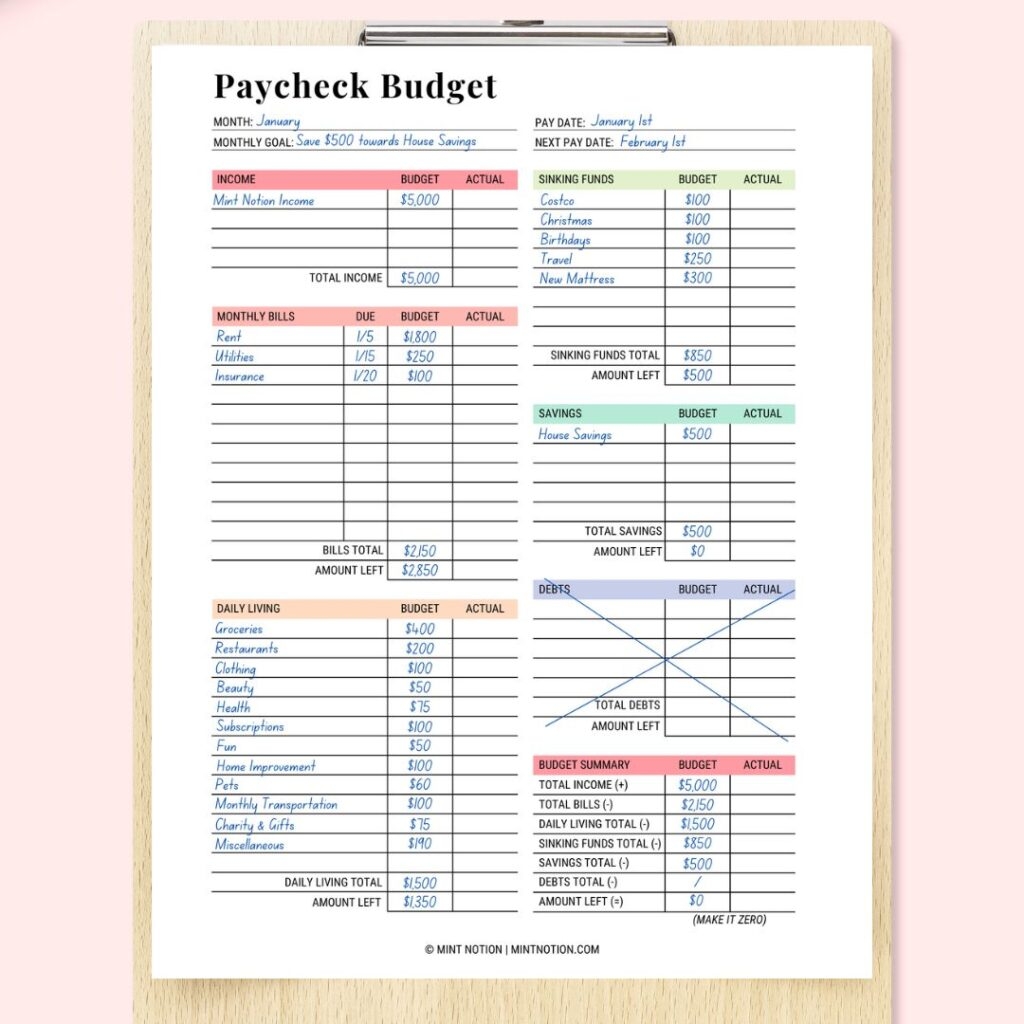

Paycheck Budget biweekly Budget finance Binder budget By Paycheck

Bi Weekly Budget Planner Template Paycheck Budget Printable

How To Budget Biweekly Paychecks Step by Step Guide Mint Notion

How To Create A Biweekly Budget In 5 Simple Steps FinancialEdge