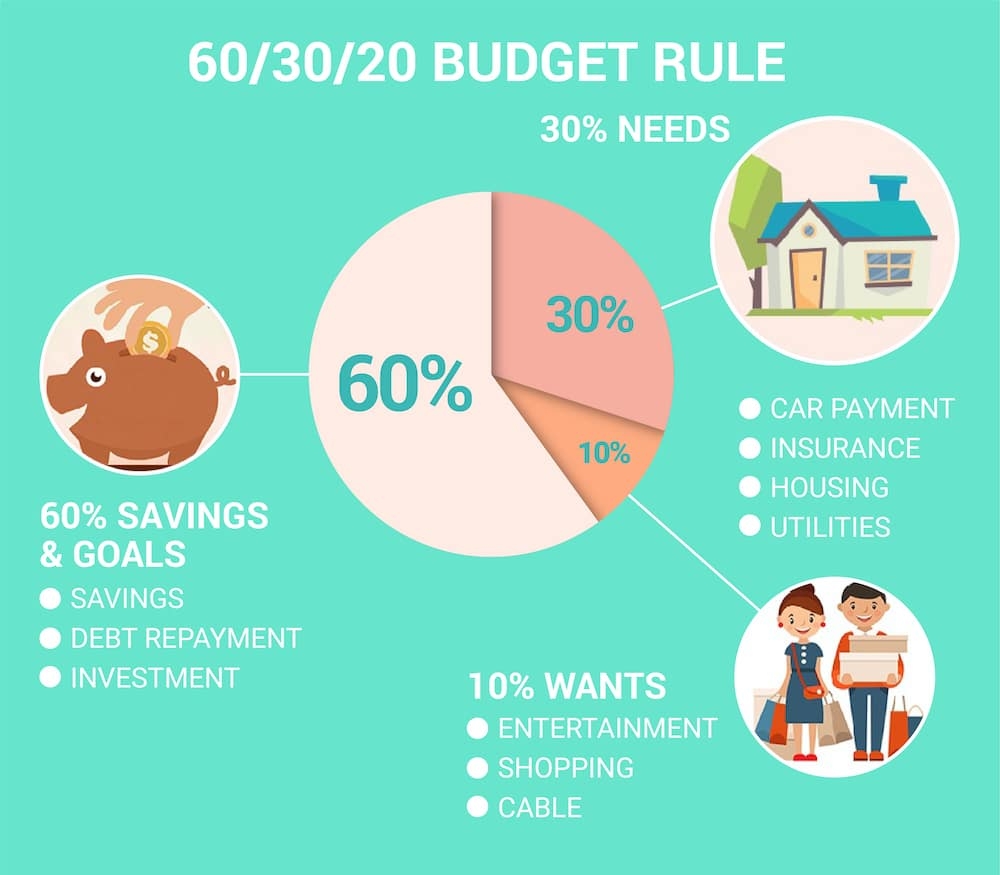

Are you looking for a simple way to manage your finances effectively? Look no further than the 60/30/10 budget template! This easy-to-use tool can help you track your spending, save for the future, and achieve your financial goals.

With the 60/30/10 budget template, you allocate 60% of your income to essentials like rent, utilities, and groceries. Then, 30% goes towards discretionary spending on things like dining out or entertainment. The remaining 10% is set aside for savings and debt repayment.

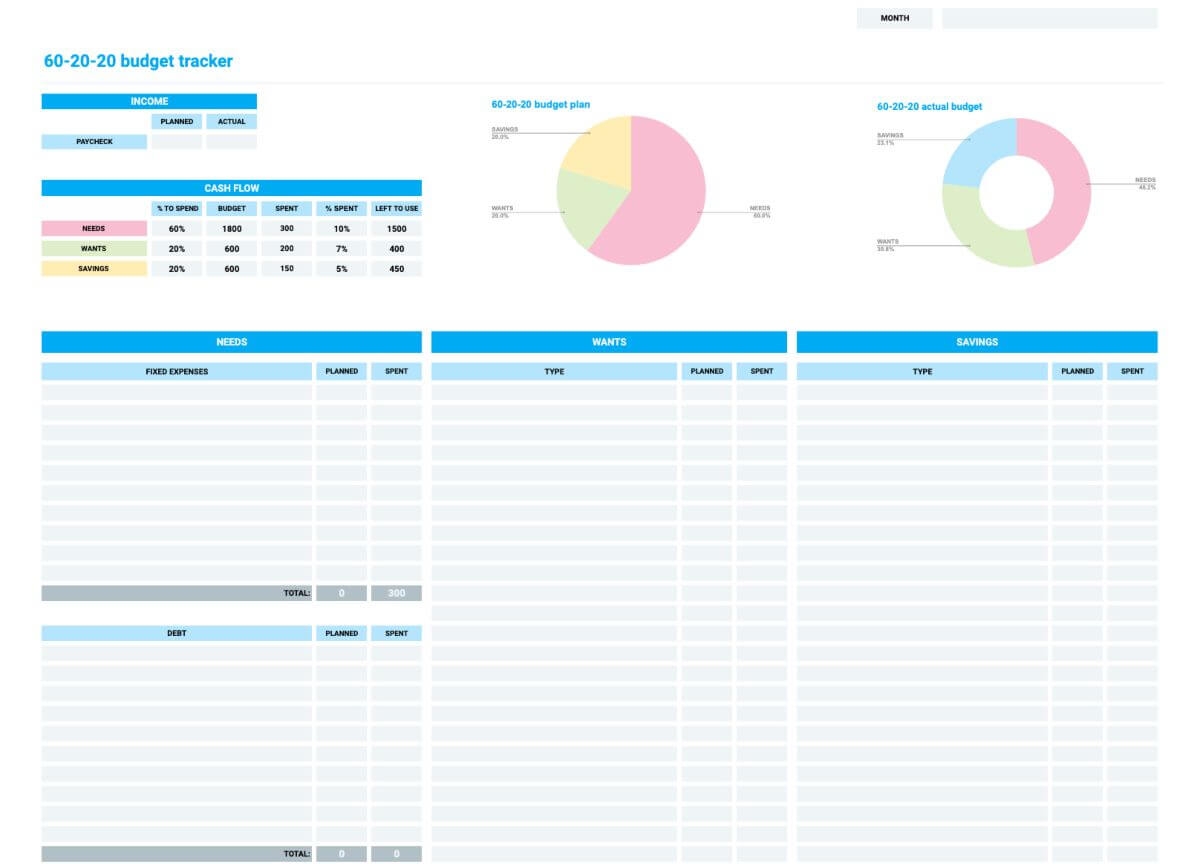

60/30/10 Budget Template

Benefits of Using the 60/30/10 Budget Template

One of the main benefits of this budgeting method is its simplicity. You don’t need to track every single expense or create complicated spreadsheets. By following the 60/30/10 rule, you can easily see where your money is going and make adjustments as needed.

Another advantage is that the 60/30/10 budget template encourages you to prioritize saving and debt repayment. By automatically setting aside 10% of your income for these purposes, you can build an emergency fund, pay off debt faster, and work towards long-term financial stability.

Overall, the 60/30/10 budget template is a practical and effective tool for managing your finances. Whether you’re just starting out on your financial journey or looking to improve your current budgeting system, give this method a try and see the positive impact it can have on your financial well-being.

Start using the 60/30/10 budget template today and take control of your finances with ease. With its straightforward approach and focus on saving and debt repayment, this budgeting method can help you achieve your financial goals and secure a brighter financial future.

How To Use The 60 30 10 Rule Budget With Calculator And Examples

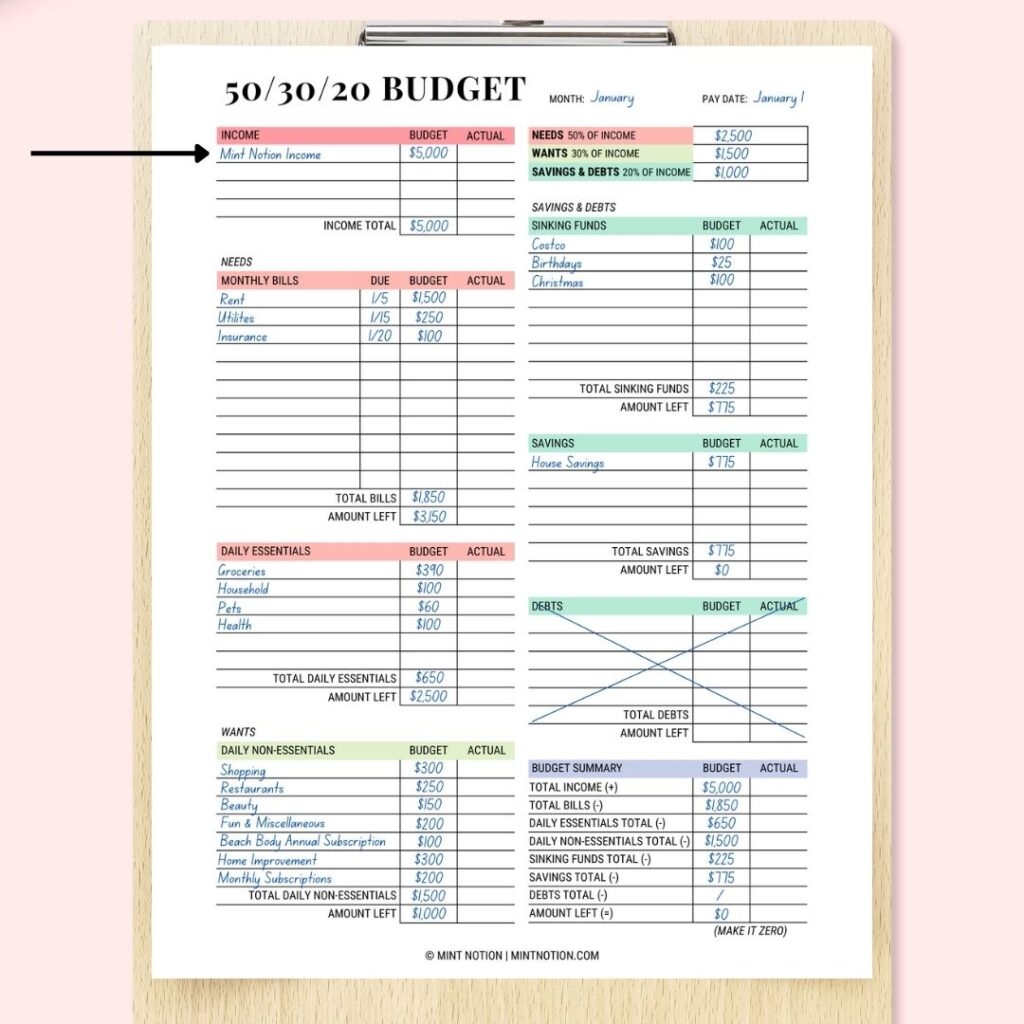

How Does The 60 30 10 Rule Budget Work Free Worksheet

50 30 20 Budget Rule How To Make A Realistic Budget Mint Notion

60 30 10 Rule Budget Explained and Can It Make You Rich Boss

60 30 10 Budget Planner Printable PDF 60 30 10 Budget Bill