Managing your finances can be overwhelming, but with the right tools, it doesn’t have to be. One useful tool is the 60 30 10 budget template, which can help you allocate your income wisely and reach your financial goals.

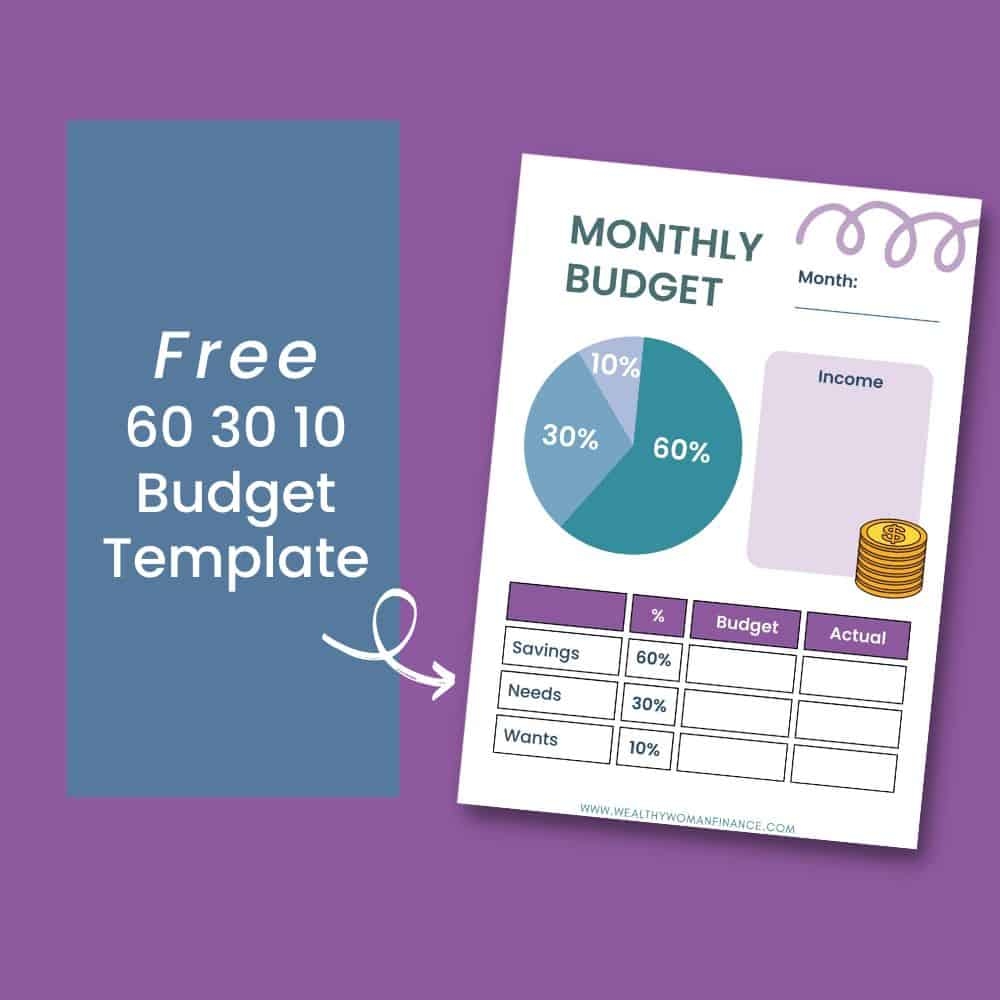

Whether you’re saving for a big purchase, planning a vacation, or just trying to stay on top of your bills, having a budget in place is essential. The 60 30 10 budget template is a simple yet effective way to divide your income into three categories: necessities, wants, and savings.

60 30 10 Budget Template

Using the 60 30 10 Budget Template

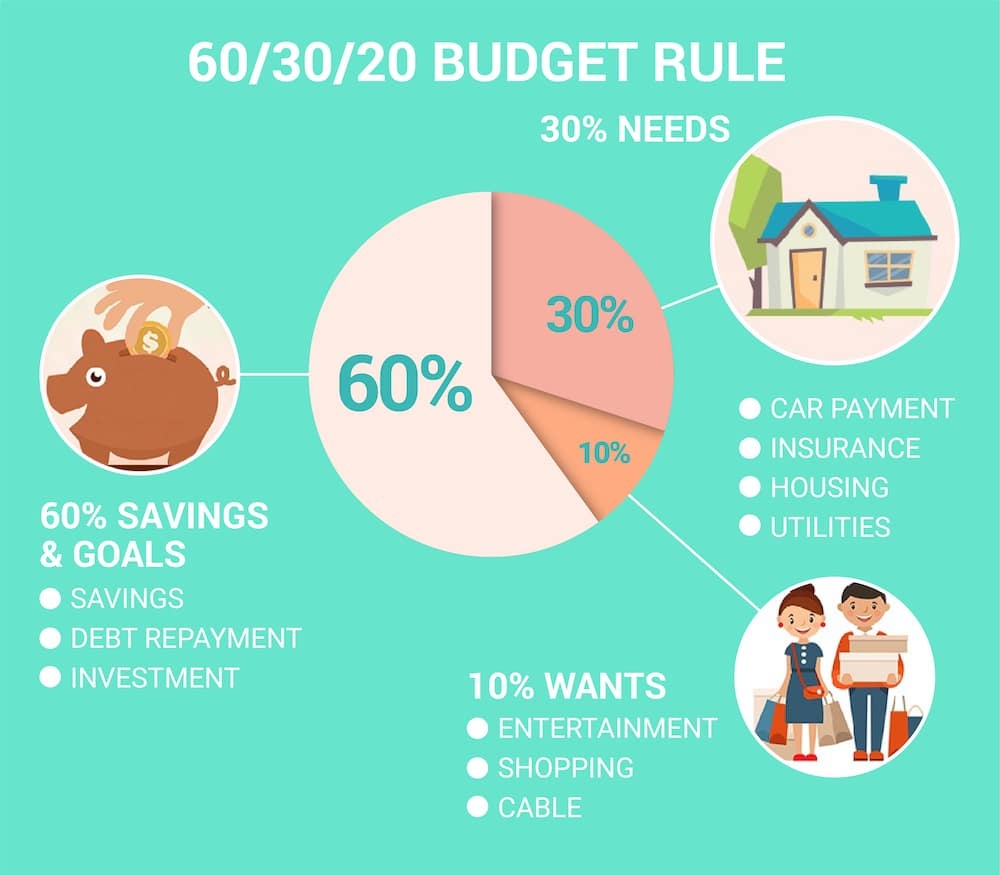

To start using the 60 30 10 budget template, first calculate your monthly income. Once you have that number, allocate 60% for necessities such as rent, utilities, groceries, and transportation. The next 30% can go towards your wants like dining out, shopping, and entertainment.

The remaining 10% should be dedicated to savings, whether it’s for an emergency fund, retirement, or a specific financial goal. By following this simple budgeting method, you can ensure that you’re prioritizing your financial well-being while still allowing yourself some room for fun and flexibility.

Remember, a budget is a flexible tool that can be adjusted as needed. If you find that your spending habits or income change, don’t be afraid to tweak your budget accordingly. The key is to stay mindful of your financial situation and make adjustments as necessary to stay on track towards your goals.

In conclusion, the 60 30 10 budget template is a straightforward and practical way to manage your finances effectively. By allocating your income wisely and prioritizing your needs, wants, and savings, you can take control of your financial future and make smarter money decisions.

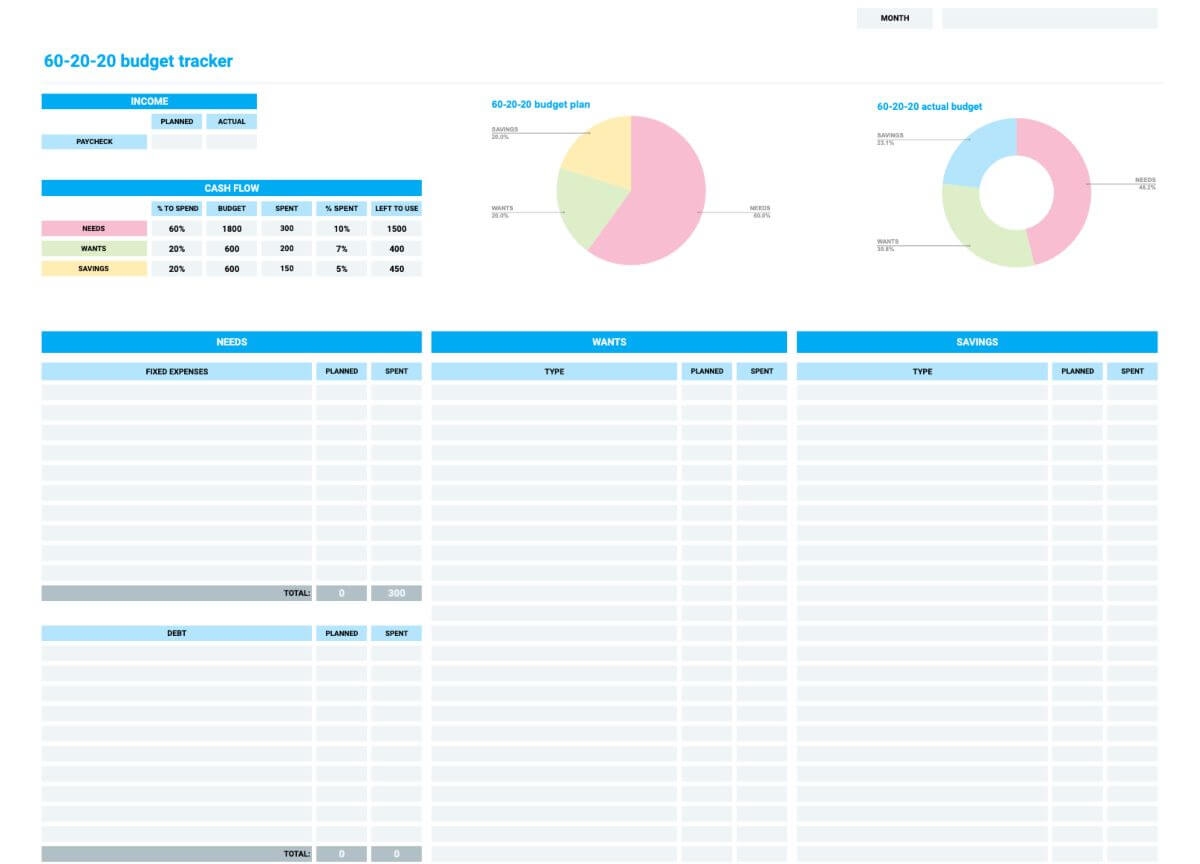

How To Use The 60 30 10 Rule Budget With Calculator And Examples

How Does The 60 30 10 Rule Budget Work Free Worksheet

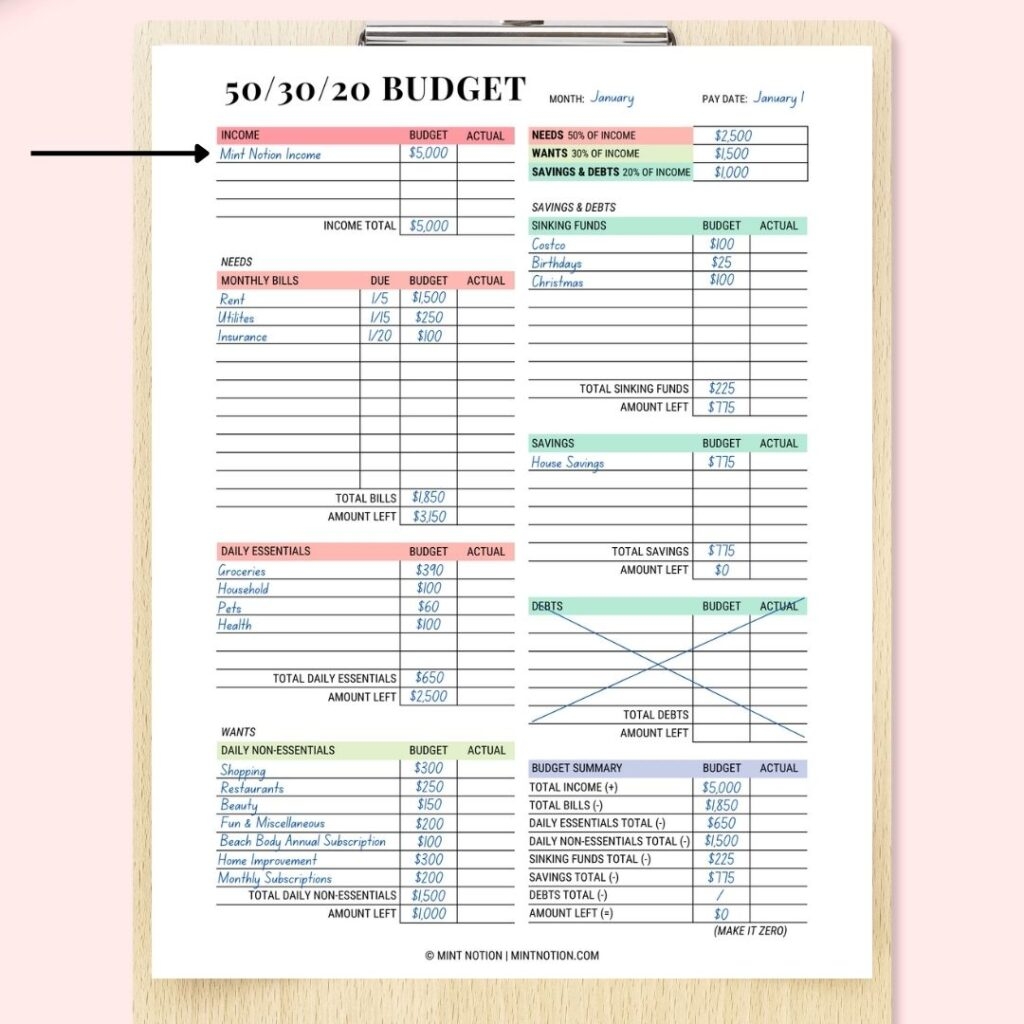

50 30 20 Budget Rule How To Make A Realistic Budget Mint Notion

60 30 10 Rule Budget Explained and Can It Make You Rich Boss

60 30 10 Budget Planner Printable PDF 60 30 10 Budget Bill